Bank Supervision May Actually Drive Corruption

Traditional approaches to bank supervision may actually hurt bank development and lead to greater corruption in lending, according to new research by Brown University Professor of Economics Ross Levine. Based on new data from more than 2500 firms across 37 countries, Levine and his co-researchers put forth the first empirical assessment how different bank supervisory policies impact the obstacles the firms face in trying raise capital. Their results are published in the current issue of the Journal of Monetary Economics.

Currently, international organizations such as the Basel Committee, International Monetary Fund, and World Bank promote the development of powerful bank supervisory agencies with the authority to monitor and discipline banks. In fact, already more than 100 countries have stated intentions to implement the new Basel Capital Accord (Basel II) in the near future. Yet, according to Levine, there exists no evidence to support these recommendations, nor is there evidence on the general question of which bank supervisory policies facilitate efficient corporate finance.

“Banks matter. They matter for economic growth and for poverty alleviation. They influence who has economic opportunities, and who never gets the chance to fulfill his or her dreams,” Levine explained. “Unfortunately, much of the world is in the process of adopting the wrong banking policies.”

After assembling the first international database on banking policies, Levine and his co-authors assessed which policies promote sound banking around the world, judged in terms of stability, bank development, efficiency, corruption in lending, and corporate governance of banks. They compared countries that choose a hands-on approach, where the government owns much of the banking industry and creates a powerful supervisory agency that directly oversees banks, to countries that rely substantially less on direct government control and put greater emphasis on forcing banks to disclose accurate information to the public.

Their results support the following two conclusions:

– Powerful supervisory agencies with the authority to directly monitor and discipline banks do not improve bank operations; rather, powerful supervisory agencies tend to lower the integrity of bank lending.

– Bank supervisory strategies that focus on forcing accurate information disclosure and not distorting the incentives of private creditors to monitor banks enhance the efficiency of banks and reduce corruption in lending.

Based on this evidence, Levine says that 90 percent of the countries planning to implement Basel II regulations could face bad outcomes – including China, India, and Russia.

“This is not a laissez-faire finding,” the report concludes. “This result suggests that active bank supervision can help ease information costs and improve the integrity of bank lending. Just as clearly, however, the results highlight the importance of theories that emphasize political and regulatory capture and suggest that powerful supervisory agencies too frequently do not act in the best interests of society.”

Thorsten Beck and Asli Demirgüç-Kunt of World Bank collaborated with Levine on this research. World Bank funded the study.

Editors: Brown University has a fiber link television studio available for domestic and international live and taped interviews, and maintains an ISDN line for radio interviews. For more information, call (401) 863-2476.

Media Contact

More Information:

http://www.Brown.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

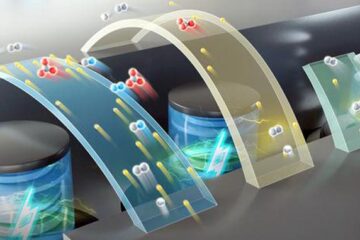

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

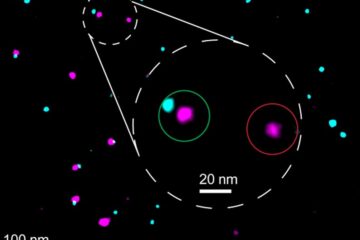

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…