Is there a bubble in the art market?

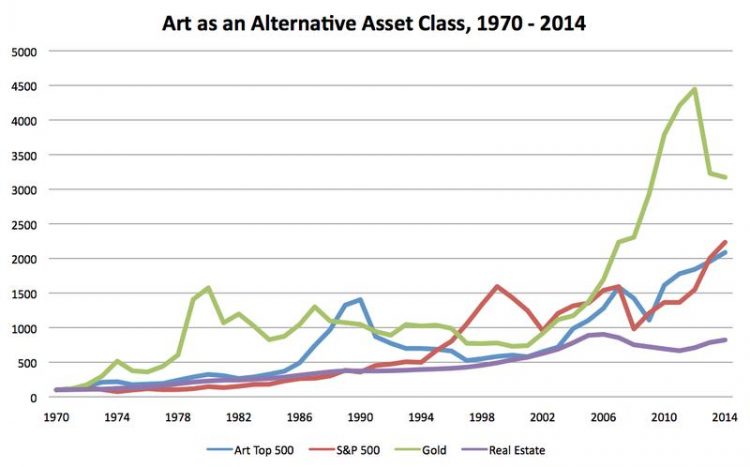

Graph showing the dip in the art market in the early 1990s as well as the striking recovery following the 2008/09 crisis, based on the top 500 artists, compared to gold, real estate, S&P index Luxembourg School of Finance

Few sectors of the market have rebounded as robustly as art – particularly contemporary art, which has doubled in value since the beginning of the financial recovery following the 2008/09 financial market crisis.

Pundits on the side-lines have commented that such market growth is unsustainable, warning there is a bubble in the making that is sure to burst, as seen in the early 1990s and in 2008/09. Headline-grabbing sales of post-war and contemporary works for over $100 million appear to support this argument. But is a bubble really forming?

Market bubbles are generally defined as a dramatic escalation in the volume of trading in assets at prices that exceed their fundamental value, followed by a sudden collapse. Rational expectations put the fundamental value of an asset as equal to its expected discounted cash flow.

For most assets it is relatively easy to project this value – for example through dividends on stocks or rent on real estate. In the case of art, however, returns can rarely be correlated to costs of production.

To overcome this fundamental issue, Dr Roman Kräussl, Prof. Thorsten Lehnert and Dr Nicolas Martelin, all from the Luxembourg School of Finance at the University of Luxembourg, have used a new and direct statistical method of bubble detection.

They analysed more than one million auction records from the past 36 years, examining six major art styles.

They were thereby able to identify two historical speculative bubbles and find an explosive movement in today’s “Impressionist and Modern”, “Post-War and Contemporary”, “American” and “Old Masters” fine art market segments. In their research, published in the Journal of Empirical Finance, they conclude that today’s art market shows sign of overheating, raising the potential of a severe correction in the foreseeable future.

http://www.sciencedirect.com/science/article/pii/S0927539815001085 – Link to the publication

http://wwwen.uni.lu/recherche/fdef/luxembourg_school_of_finance_research_in_fina… – Personal page of Prof. Roman Kräussl

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

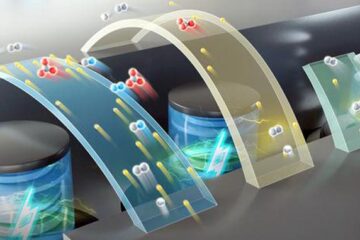

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

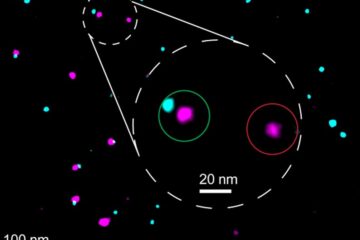

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…