Monetary policy does reduce unemployment – are unions right to hold contrary views?

Recent monetary policy has helped control inflation which, in turn, has kept unemployment rates low according to detailed research funded by the Economic and Social Research Council.

The wider economic community is reluctant to accept that monetary policy affects the underlying natural rate of unemployment. However, in the light of the research, there is clear evidence to suggest that these views should be re-thought. Unions may need to change their stance on interest rate control and its perceived negative impact on employment rates. The studies, carried out by Professor Christopher Martin, Department of Economics and Finance, Brunel University and Dr George Bratsiotis, School of Economic Studies, University of Manchester, reveal that wage rises have a greater detrimental impact on employment levels when monetary policies are aimed at stabilising inflation.

In the models used in the research, policy makers are assumed to be far more concerned about inflation and output. A stronger preference for low inflation, for example by targeting, results in lower unemployment rates. If this is the case, and the research strongly suggests it is, supporting monetary policy which seeks to control inflation, would be in the greatest interest of trade union members and all workers.

Part of the research involved analysing and estimating two theoretical economic models. One aims to show how changes in monetary policy has an impact on unemployment rates and the other on how higher wages leads to increases in unemployment levels. The models, that have been developed and adapted from existing economic theories, were then tested against historical data and actual experience over the last three decades to see how well they performed.

“We think we’ve come up with a model that explains the data much better than some of the more conventional ones that have fixed parameters,” said Professor Martin. “With monetary policy changes factored in, we’re able to estimate employment rates much more accurately. The trouble with conventional models is that they can’t explain the low unemployment rates of the last ten years.”

Using the first model, for example, it was found that granting independence to the Bank of England in 1997 had very little impact on the rate of unemployment. In addition, in estimating the effects of inflation targeting policies over a ten-year period (1992-2001), the model was found to accurately predict the lower rates of unemployment that were actually recorded. In analysing such findings and other tests that were applied to the model, Professor Martin and Dr Bratsiotis concluded that there is, ’strong empirical support for our approach’. In future, all economists attempting to make predictions about unemployment levels would be well advised to use their ’variable parameters’ model.

In using the second model, Professor Martin points out that there are two channels through which higher wages reduce employment levels. “Companies experience what we call a ‘relative price effect’. In paying higher wages, their goods and services need to become more expensive which can lead to a fall in demand – forcing them to cut labour,” said Professor Martin. “Firms do this to themselves, which means it’s not subject to monetary policy.”

On the other hand, Professor Martin explains, a second channel, which they call the ‘aggregate demand effect’, is determined by monetary policy. “This effect can be demonstrated through monetary policy that seeks to stabilise employment levels by increasing the money supply – which offsets higher prices – it actually helps keep employment levels stable throughout the economy. By contrast, if price levels are stabilised by reducing the money supply, then the reduction in employment is intensified – people loose their jobs.”

Media Contact

More Information:

http://www.esrc.ac.ukAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

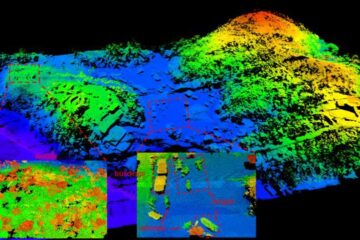

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…