Companies: Beware Hazards of Getting Too Big Too Fast, Says Study in April Management Insights

Management Insights, a regular feature of the journal, is a digest of important research in business, management, operations research, and management science. It appears in every issue of the monthly journal.

“Getting Big Too Fast: Strategic Dynamics with Increasing Returns and Bounded Rationality” is by John D. Sterman and Rebecca Henderson of MIT’s Sloan School of Management; Eric D. Beinhocker, McKinsey Global Institute; and Lee I. Newman, Department of Psychology, University of Michigan.

Positive feedbacks such as network effects, scale economies, and learning curves are increasingly important in hi-tech, information-age industries. Strategy literature generally recommends that firms in such industries pursue “get big fast” (GBF) strategies, expanding capacity and production rapidly, and cutting prices—often below current costs—to gain market share and grow faster than their rivals, thus building the resources and competitive advantages needed to dominate the market.

The authors find, however, that such aggressive strategies often lead to overcapacity when the market saturates. The resulting losses can overwhelm the advantages of market share leadership, which happened during the collapse of the technology bubble in 2001.

The authors developed a simulation model that shows the conditions under which forecasting errors leading to capacity overshoot and large losses are likely. Rather than expanding aggressively when the risk of capacity overshoot is high, they recommend that firms consider conservative strategies, allowing less sensible rivals to play the aggressive strategy, then buying these rivals at distress prices when they fail during the transition from boom to bust.

The current issue of Management Insights is available at http://mansci.journal.informs.org/cgi/reprint/53/4/iv. The full papers associated with the Insights are available to Management Science subscribers. Individual papers can be purchased at http://institutions.informs.org. Additional issues of Management Insights can be accessed at http://mansci.pubs.informs.org/.

The Insights in the current issue are:

- Biform Games by Adam Brandenburger, Harborne Stuart

- The Horizontal Scope of the Firm: Organizational Tradeoffs vs. Buyer-Supplier Relationships by Olivier Chatain, Peter Zemsky

- Brokers and Competitive Advantage by Michael D. Ryall, Olav Sorenson

- Wintel: Cooperation and Conflict by Ramon Casadesus-Masanell, David B. Yoffie

- Interdependency, Competition and Industry Dynamics by Michael J. Lenox, Scott F. Rockart, Arie Y. Lewin

- The Timing of Resource Development and Sustainable Competitive Advantage by Gonçalo Pacheco-de-Almeida, Peter Zemsky

- Strategic Management of R&D Pipelines with Cospecialized Investments and Technology Markets by Tat Chan, Jack A. Nickerson, Hideo Owan

INFORMS journals are strongly cited in Journal Citation Reports, an industry source. In the JCR subject category “operations research and management science,” Management Science ranked in the top 10 along with two other INFORMS journals.

The special MBA issue published by Business Week includes Management Science and two other INFORMS journals in its list of 20 top academic journals that are used to evaluate business school programs. Financial Times includes Management Science and four other INFORMS journals in its list of academic journals used to evaluate MBA programs.

About INFORMS

The Institute for Operations Research and the Management Sciences (INFORMS®) is an international scientific society with 10,000 members, including Nobel Prize laureates, dedicated to applying scientific methods to help improve decision-making, management, and operations. Members of INFORMS work in business, government, and academia. They are represented in fields as diverse as airlines, health care, law enforcement, the military, financial engineering, and telecommunications.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

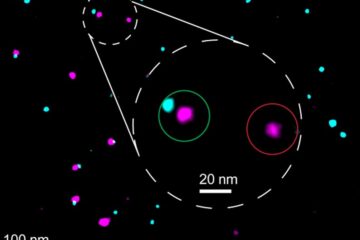

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…