Credit cards' insidious effects may pose product liability issue

When issuing loans for cars, home mortgages and other forms of debt, banks conduct a thorough credit screening of applicants. But when the same banks issue loans in the form of credit cards, “people with bad credit histories, as well as those who have declared bankruptcy or who have an income level that is too low to justify the credit lines that they are given, all receive high-interest credit,” Goldstein wrote.

Credit-card debt also differs from more standard credit arrangements in the assessment of late fees and interest rates. This is largely a result of the National Bank Act of 1864, which exempts national banks from state consumer-protection laws that can limit the rate of interest charged to a state resident, and regulate debt-collecting and credit-reporting standards.

What's more, according to Goldstein, the marketing techniques and incentive programs used by credit-card companies induce consumers to overspend and amass debt. A 2002 medical paper described in the article links credit-card debt to various health and social problems, including insomnia, anxiety, marital breakdowns and depression.

Goldstein cited evidence that college students, inundated with direct-mail appeals by card issuers, are especially vulnerable to credit-card debt. This can lead to low grades, withdrawal from school and difficulty in finding future employment because credit checks are becoming a common feature of job applications.

The rapid increase in consumer indebtedness in the U.S. has been largely confined to credit cards and has not characterized other types of consumer credit. “This indicates that there is something singular about the design of credit cards that uniquely causes people to accumulate too much debt,” Goldstein wrote.

A key principle of product liability is that the design of a product is defective and that safer alternative designs are available. A unique feature of credit cards is that “they allow debt to be incurred bit by bit, in a series of charges, none of which exceed $20 or $30 each, that can amass quickly into thousands of dollars,” Goldstein noted.

In addition, by grouping payments into a single transaction every month, credit cards reduce a consumer's sensitivity to price and promote impulse buying, a fact that credit-card issuers encourage through tug-at-your-heart commercials and other advertising.

“People tend to underestimate future borrowing and correspondingly overestimate or be overly optimistic about their future ability to pay off whatever balances they may accrue,” Goldstein wrote. “This causes people to be more responsive to short-term factors, such as annual fees, and less sensitive to the long-term elements of credit-card price.”

Visa is the largest credit-card company, with about 1 billion cards in circulation. It is a private corporation owned by 21,000 banks, each of which issues and markets its own Visa products. The second largest issuer, MasterCard International, is an association of 22,000 member banks.

Goldstein is critical of low introductory interest rates offered to new card owners that go up dramatically after six or 18 months. “It is these high, long-term interest rates that result in faster debt growth and accelerate negative social and individual consequences of such debt,” he wrote.

Between 1993 and 2000, consumer credit lines tripled from $777 billion to more than $3 trillion. The amount of credit-card debt held by Americans has grown by an equal amount, with the average adult today using six card accounts and the average household card debt conservatively estimated at $12,000.

A case of products liability could be grounded in legal theories of defective design, according to the article. One aspect of credit-card design – the minimum monthly payment feature – accelerates a consumer's overall indebtedness and benefits banks through the high interest assessed on the outstanding debt.

“Because the goal of products liability is to force manufacturers to internalize the costs associated with product risks, it follows that credit-card features that have minimum payment structures should be recognized as defects,” Goldstein concluded.

His article is titled, “Why 'It Pays' to 'Leave Home Without It': Examining the Legal Culpability of Credit Card Issuers Under Tort Principles of Products Liability.”

Media Contact

More Information:

http://www.uiuc.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

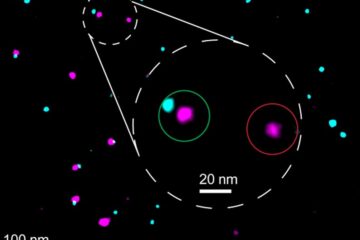

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…