Finance: Belief in higher returns from private equity may be misplaced

Many investors believe that higher returns can be achieved by investing in funds which buy firms not listed on stock markets (so-called private equity investment funds) rather than those funds that invest in listed companies.

Private equity funds have become increasingly popular recently with large institution (particularly pension funds and insurance companies), as well as wealthy individuals seeking high returns in an era of low interest rates.

But are they making a mistake? Previous academic studies would suggest not, but doubt has now been cast about the higher profitability of private equity funds by research* carried out by Dr Roman Kräussl of the Luxembourg School of Finance (University of Luxembourg) together with Narashim Jegadeesh (Goizueta Business School, Emory University and NBER) and Joshua M. Pollet (College of Business at the University of Illinois at Urbana-Champaign).

“Existing studies are susceptible to selection bias,” explained Dr Kräussl. “They rely on information reported by the funds' general partners or from large investors, but their experiences are often different from those of the typical private equity investor. We found a way to avoid this selection bias,” he said.

Dr Kräussl and his colleagues studied the stock market performance of funds that hold portfolios of private equity limited partnerships. This is a reliable proxy for measuring private equity investment returns because these firms' share prices fluctuate with the performance of their investment portfolios.

Using this measure suggests that expectations of long-term performance of private equity investments would vary little from the performance of normal stock market indices (between -0.5 per cent and +2.0 per cent). In other words, expected returns are very similar to those of holding listed securities on the major exchanges.

Also, the systematic risk of start-ups (i.e. private equity investment) was found to be similar to investing in publicly traded stocks of small and medium-sized companies.

The paper is due to be published in the prestigious academic journal The Review of Financial Studies.

* “Risk and Expected Returns of Private Equity Investments: Evidence Based on Market Prices”, Jegadeesh, Kräussl and Pollet has been accepted for publication in The Review of Financial Studies. DOI: 10.2139/ssrn.1364776

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1364776 – draft of the paper to be published by the Review of Financial Studies

http://wwwen.uni.lu/recherche/fdef/luxembourg_school_of_finance_research_in_fina… – Personal page of researcher Prof. Roman Kräussl

http://www.uni.lu – homepage of the University of Luxembourg

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

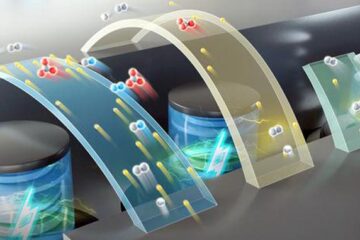

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

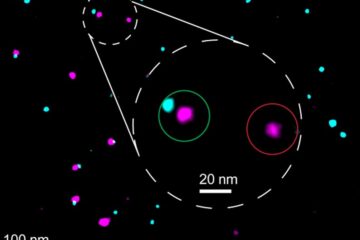

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…