It’s a Double-Witching Hour for Homebuyers

If you missed the deadline, don’t panic – relief is on the way, according to Richard Marmon, an associate professor of accounting in the Rohrer College of Business at Rowan University, Glassboro, N.J., who holds advanced degrees in business, law and tax and is a certified public accountant, certified management accountant and licensed attorney.

The Senate approved the “Homebuyer Assistance and Improvement Act of 2010” (HR. 5623) by unanimous consent, the day after the House’s approval by a vote of 409-5. This much-needed legislation, which extends the date on which a taxpayer has to close a real estate purchase to Sept. 30, 2010, was signed by the President on July 2.

In addition, New Jersey Gov. Chris Christie is poised to sign a similar state tax credit available for those who purchase a residence in New Jersey during calendar year 2010 (he has 45 days from June 10). The “New Jersey Home Buyer Tax Credit Program” (NJHTC) provides home buyers with a refundable tax credit of up to $15,000 or 5 percent of the home purchase price, whichever is less. If passed, this propitious pairing will provide a whopping $23,000 in cash for some taxpayers who buy a home before Oct. 1, 2010.

The federal credit is available for individuals and married couples who have not owned a home in the past three years and are currently under a written binding contract, dated prior to May 1, 2010, for the purchase of a principal residence. The credit, provided for in I.R.C. Code Sec. 36, is equal to the lesser of $8,000 for married couples ($4,000 for married individuals filing separately) or 10 percent of the home’s purchase price.

Also, “long-time residents” who purchase a home after Nov. 9, 2009, may claim the credit as long as they have occupied the same principal residence for at least five consecutive years during the eight-year period ending on the settlement date of the new home. However, the credit for long-time residents is limited to the lesser of $6,500 for married couples ($3,250 for married individuals filing separately) or 10 percent of the home’s purchase price. The federal credit has a modified adjusted gross income phase-out between $125,000 and $145,000 (single filers) and $225,000 and $245,000 for those filing a joint return. Other limitations prohibit dependents from claiming the credit, buyers under the age of 18 and any buyer or their spouse related to the seller. Qualified armed service members on official duty outside the U.S. are granted an additional year to settle on their new home for purposes of the credit. There is a recapture provision that is waived for 2009 and 2010 purchases as long as the buyer continues to use the home as a principal residence for three years (Code Sec. 36(f)(4)(D)).

To claim the credit, taxpayers must file a paper return and include Form 5405, “First Time Homebuyer Credit and Repayment of the Credit” with their Form 1040. Form 5405 provides for additional documentation to be submitted to the I.R.S. including one of the following documents: (1) a properly executed HUD-1 settlement sheet showing the names of the parties, signatures, property address, date and purchase price, (2) a copy of the executed retail sales contract or (3) for newly constructed homes where a HUD-1 is not available, a certificate of occupancy. There are additional reporting requirements for those seeking the long-time resident credit to substantiate the five-year home ownership requirement, including property tax records and mortgage interest statements.

The New Jersey homebuyer credit is even better than the federal credit – up to $15,000 awaits buyers who purchase a home this year. The credit is the lesser of five percent of the purchase price of the home or $15,000 provided that the taxpayer continues to occupy the home as a primary residence for 36 consecutive months after the closing. There’s only one small catch with the state credit: you don’t get all of the money in the year of purchase; rather you claim one-third of the total each year for three years. The good part is that the credit is refundable, which means you get the money regardless of your tax liability. Because the funding for this credit is capped at $100 million, taxpayers must apply for a determination of their preliminary eligibility to claim the credit from the Director of the Division of Taxation on a first-come, first-serve basis. The application must include a buyer’s certification that the home will be used as a primary residence for at least three consecutive years and a seller’s certification that any property qualifying as a new home has not previously been occupied as a principal residence.

Together, these credits are a boon to present homebuyers and are hoped to revive the recession-struck homebuilding industry and stimulate economic growth throughout the remainder of this year. Affected taxpayers can seek additional guidance by consulting IRS Publication No. 530 and the NJ State Legislative website at http://www.njleg.state.nj.us.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

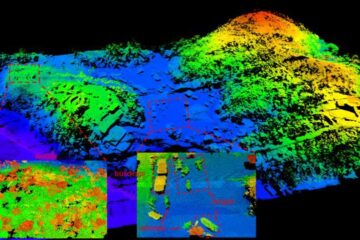

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…