Cass Business School to track performance of private equity backed IPOs on London market

The research will assess the attractiveness of the London markets for private equity backed IPOs and will be based on two key aspects of performance; relative importance of different exit routes and initial and long term aftermarket performance.

This project will focus on IPOs which have been floated in recent years. The data for the research, provided by the London Stock Exchange, is being made exclusively available to Cass for this project.

The rapid growth of the private equity industry in recent years has created a lively debate on the economic benefits, potential risks, the performance of private equity backed companies and the role of stock exchanges as a means of divestment.

The research will be an ongoing piece of work with a yearly release on aftermarket performance and six month updates on exit routes. It is aimed that the first yearly release and full launch of the research piece will be in February 2008.

Simon Walker, Chief Executive of the BVCA said: “This is an important piece of research that should help to demonstrate just how much value private equity adds to the companies in which it invests. It is also another step in the right direction towards demystifying the work we do in private equity and explaining why the industry is a global success story for the UK.”

Nick Langford, Head of UK Business Development & Corporate Advisers Company Services, London Stock Exchange, said: “The London Stock Exchange provides a choice of efficient primary markets designed to give issuers off all types the best possible opportunity to raise capital and maximise the value of their company. This research will demonstrate the opportunities that our markets offer the private equity investment community in realising their investment goals.”

Professor Levis said: “The popularity of private equity backed companies floating on the London Stock Exchange is a recent phenomenon which has not been widely studied. This research aims to determine the level of success these companies achieve, which may also indicate why companies find the London markets so attractive.”

Cass is committed to continued research into private equity and Mario Levis is heading up the Cass Private Equity Centre which will promote understanding and provide evidence of the key issues and challenges facing participants in the private equity industry. For more information please visit http://www.cass.city.ac.uk/cpec/.

Media Contact

More Information:

http://www.cass.city.ac.uk/media/story_3_1148_86239.htmlAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

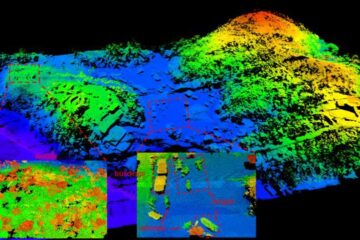

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…