Owning too much company stock puts workers' retirement at risk

Sean Anderson says employee stock ownership plans, or ESOPs, are the biggest threat, with even heavier investment in company stock than the 401(k) plan that gobbled up workers' savings when energy giant Enron Corp. collapsed amid scandal in 2001.

Workers whose employers have ESOPs also typically have no choice about whether to invest in company stock, said Anderson, who wrote an article that will appear in the Loyola University Chicago Law Journal.

“ESOPs have a lot of intuitive appeal – the idea of having workers own a piece of the company they're working for,” he said. “But they're Enron on steroids. At the end of the day, they put workers at terrible risk and more often than not work as a tool that benefits the company, not employees.”

ESOPs are dicey even beyond the doomsday scenario of a company bankruptcy that strips away workers' savings along with their jobs and benefits, said Anderson, a visiting professor in the U. of. I. College of Law.

He says ESOPs defy modern portfolio theory, concentrating investments in a single firm rather than diversifying across a wide range of companies, industries and even geographic areas to minimize risk.

“Someone who has the bulk of their portfolio in one investment is just not going to do as well as someone who has a diversified portfolio,” Anderson said. “Over time, undiversified investments through ESOPs can be worth far less than half as much.”

The problem is made worse, he says, by the fact that ESOP participants typically have no control over the prices at which the ESOP buys shares. Most ESOP companies are privately held, so the share price for ESOP stock transactions is determined by company-hired valuation firms with an incentive to set high prices that net extra cash for the business or its insiders rather than low prices that benefit employees, he said.

“These firms are hired by the company and do this over and over, so it's not in their best interests to stick up too ferociously for ESOP participants,” he said. “If they get a reputation for bucking the company, they'll lose business.”

Anderson says setting share prices is just one of several incentives that combine to make ESOPs a better deal for the company than for the employees they are supposed to help.

For example, he says ESOPs are the only tax-qualified retirement plan that can borrow money, making them an effective means of raising capital. He says companies can then deduct all of the interest on those loans, providing a much bigger tax break than comparable 401(k) or other pension plans.

Owners of privately held firms who sell shares to the ESOP rather than an outside buyer also can defer capital gains taxes if they invest the proceeds in other stocks, Anderson said, an incentive for owners who are retiring or merely seeking to diversify their own investments.

“Because of those conflicts of interest, some people have said it's better to think of ESOPs as instruments of corporate finance rather than retirement plans,” he said. “That's the problem. Employees think they have a pension plan, so they're less inclined to agitate for a better one because they don't realize what a bad position they're in.”

Anderson says ESOP reforms have failed, even escaping a post-Enron federal mandate that requires 401(k) plans to give workers more freedom to diversify investments and to educate them about the importance of diversification.

The ideal solution, he says, is banning employer stock from both ESOPs and other retirement plans. A 5 or 10 percent cap on company stock also would solve diversification concerns, he says, but would be cumbersome to regulate.

“I do have a glimmer of hope that the horrible things happening in the investment world will make the ground a little more fertile for arguments against ESOPs,” Anderson said.

“Ironically, ESOP participants would be better off if the company just randomly chose the stock of a similar firm in the same industry,” he said. “They'd still be radically under-diversified, but at least their pay and benefits would be in a different basket than their retirement savings.”

Media Contact

More Information:

http://www.illinois.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

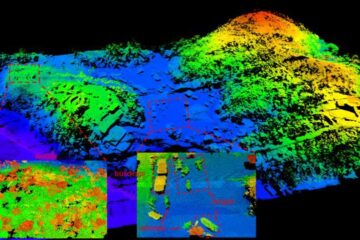

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…