Research Finds That Even After the Bubble, Real Estate Remains Part of a Strong Portfolio

Jay Sa-Aadu and Ashish Tiwari, finance professors in the Tippie College of Business, and Jim Shilling, a finance professor at DePaul University, analyzed the performance of diversified investment portfolios that included domestic and international stocks, real estate, commodities and precious metals between 1972 and December 2008. That period, they note, includes the 2006 real estate meltdown and the first year of the recession that began in 2007.

Yet, despite the poor performance of real estate recently, those portfolios that included investments in real estate investment trusts (REIT) performed better than those that did not.

“In a long-term investment strategy, our research suggests that real estate provides stability to a portfolio during bad times,” said Sa-Aadu.

In their study, Sa-Aadu and Tiwari started with a portfolio that was made up of large and medium cap stocks and Treasury bonds, then added various other asset classes to see how they affected performance over time from 1972 through December 2008. They found that the addition of REITs, corporate bonds, small cap stocks, international stocks and commodities and precious metals resulted in significant diversification gains. However, the various asset classes differed in important respects in terms of the timeliness of the gains.

A key result of the research is that the benefit of real estate and commodities and precious metals is most pronounced during a poor economy. Even when real estate does poorly, they said, it does less poorly than other asset classes, providing the portfolio stability.

“We found that real estate and commodities and precious metals are the two asset classes the deliver portfolio gains when consumption growth is low or volatile, when investors really care for such benefits,” said Sa-Aadu and Tiwari in their paper, “On the Portfolio Properties of Real Estate in Good Times and Bad Times.” The paper is forthcoming in the journal Real Estate Economics.

They said their findings on the performance of real estate in good economic times and bad suggest that the typical institutional allocation to real estate may be underweighted.

Their research suggests that during their study period, the optimal portfolio during good economic times would hold mostly domestic stocks (34 percent), with international stocks (25 percent), government bonds (22 percent) and real estate (15 percent) also included.

In contrast, an optimal portfolio during poor economic times would be mostly government bonds (53 percent), and also include precious metals (28 percent) and real estate (19 percent).

Sa-Aadu and Tiwari note that most institutional investors hold only 4 to 7 percent of their portfolios in real estate. Since a significant investment in real estate appeared in both of their optimal portfolios, they suggest that institutional investors consider increasing their real estate allocation for more stable portfolios long-term in both good and bad times.

They also said their study pertains to a long-term investment horizon in portfolios holding REITs, which invest mostly in multi-family housing and commercial property. It does not apply to a speculative investment strategy of purchasing single-family homes and selling them quickly.

Ashish Tiwari, 319-353-2185, ashish-tiwari@uiowa.edu

Media Contact

More Information:

http://www.uiowa.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

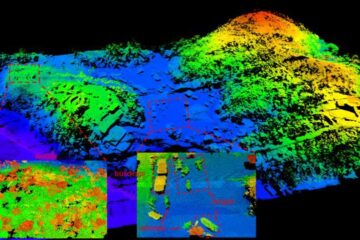

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…