Higher corporate taxes may attract foreign investment

Last week, Chancellor Gordon Brown announced that corporation tax for larger companies will be cut to 28% from April 2008. This followed an earlier pledge from the Conservatives to cut corporation tax to 27% on the grounds that the current 30% level is uncompetitive.

But in a new joint research paper, Dr Holger Görg from GEP — the Globalisation and Economic Policy Centre, based at The University of Nottingham — and Professor Hassan Molana and Dr Catia Montagna from the University of Dundee, claimed cutting taxes to become more competitive will not necessarily attract new investment.

After analysing data from 18 OECD countries over a 14 year period, the team found that the countries which attracted the highest levels of foreign investment — a key economic target of most governments — were actually the ones with higher taxes, and higher public social expenditure as a proportion of GDP.

Dr Görg, Associate Professor and Reader in Economics at GEP, said: “The results may be startling and appear to be counterintuitive.

“Most economists have always argued that globalisation leads to a ‘race-to-the-bottom’ as countries compete to cut tax rates in the hope of attracting multinational investment and the jobs that come with it. The traditional theory is that this then leads to a shrinking of tax revenues and undermines the welfare state.

“But our evidence shows that overall effective corporate tax burdens do not appear to have fallen in response to capital and trade liberalisation, that countries aren’t competing to cut taxes and actually, when investing abroad, firms find countries with higher taxes attractive because they associate them with a happy, stable workforce.”

The fear that globalisation will force countries to compete in cutting taxes and therefore welfare spending to attract investment is behind much of the recent drive to harmonise tax policies within the EU and OECD.

But the research showed that tax revenues as a percentage of GDP are on the rise in many OECD countries. Whilst many governments have reduced statutory corporate income tax rates, most have simultaneously broadened the tax base and closed various loopholes so total revenue from capital taxation has not declined. And differences in corporate tax treatments between OECD countries remain very large.

Dr Görg said: “This research suggests that commentators and economists have overstated the degree to which international investment decisions are driven by relative tax-treatment considerations.”

Among the reasons suggested by the researchers for their lack of sensitivity to taxation is the fact that multinationals have the ability to shift profits to lower-tax locations — for example by transfer pricing or intra-firm debt contracting.

Dr Görg said: “Perceptions about the host country’s economic and social environment are key to the choice of location for many multinationals. It seems that investment decisions depend on the combination of taxation and the provision of public goods and services that host countries can offer because of taxation. So an ‘unfavourable’ tax differential may lead to more and not less investment flowing into a country.”

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

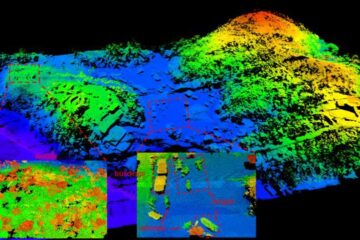

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…