Stock analysts likely punished for unfavorable recommendations

University of Washington Business School researchers have found that investor relations professionals at public companies often give less information to analysts whose stock recommendations are unfavorable and provide more information to analysts who have reputations for giving positive recommendations or promising earnings forecasts.

Dawn Matsumoto and Shuping Chen, associate and assistant professors of accounting, analyzed roughly 20,000 analyst recommendations given from September 1993 through June 2002. Using Thomson Financial's Institutional Brokers' Estimate System, or IBES, a forecast database which tracks analysts' recommendations and earnings forecasts, the researchers examined how accurately analysts are able to forecast a company's earnings after issuing a favorable vs. an unfavorable recommendation. If company managers chose to give analysts additional information, analysts would be able to forecast earnings more accurately.

The research suggests that managers give more information to analysts with more favorable recommendations. The evidence is strongest for the period before the federal Securities and Exchange Commission's passage of Regulation Fair Disclosure, which prohibits publicly traded companies from providing inside or material information to selective stock analysts. Regulation Fair Disclosure became effective in October 2000. The study does not find statistical evidence of discrimination against analysts who rate companies unfavorably after Regulation Fair Disclosure was enacted, but such discrimination existed before the rule was passed, which suggests the regulation may be marginally effective.

“Financial officers and investor relations managers have the ability to favor analysts who have more favorable opinions of their firms,” said Matsumoto. “They can use various exclusionary tactics such as barring analysts from analyst-firm meetings, refusing to return phone calls from analysts, canceling pre-scheduled meetings with the analysts and refusing to answer questions from analysts during conference calls. These tactics can have a negative impact on the analysts' job performance.”

Public companies frequently provide information to investors and analysts through a variety of channels, including analyst meetings, conference calls and news releases. The type of information a company provides can be as specific as a precise estimate of earnings per share or as broad as qualitative statements about market conditions. This company-provided information improves an analyst's ability to accurately forecast earnings and is thus an integral tool analysts rely on. Without the right information, said Matsumoto, analysts cannot make accurate predictions about a company's future, and they run the risk of losing business from investors who want a more accurate prediction of a company's future earnings or stock value.

“We found that analysts who downgrade their recommendations experience a significantly smaller increase in their relative forecast accuracy compared to analysts who upgrade their recommendation,” Matsumoto added. “There's certainly an incentive for analysts to provide positive forecasts. If analysts rationally expect a reduction in management-provided information following a negative report, they could factor this reaction into their decision and be less inclined to issue a negative report in the first place.”

According to the SEC, Regulation Fair Disclosure rules are designed to promote full and fair disclosure of company information and to clarify and enhance existing prohibitions against insider trading. Before this rule was in place, managers could provide privileged information to select analysts at large investment banks, leaving smaller investors and analysts in the dark about potentially 'market-moving' information and therefore less able to make smart investments or forecast stocks accurately, Matsumoto said.

“Our evidence suggests that Regulation Fair Disclosure has discouraged managers from using some of the exclusionary tactics they may have employed in the past — tactics that may have discouraged analysts from issuing negative reports even when a company's outlook warranted such a report,” she said.

The paper appears in the current issue of the Journal of Accounting Research.

Media Contact

More Information:

http://www.washington.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

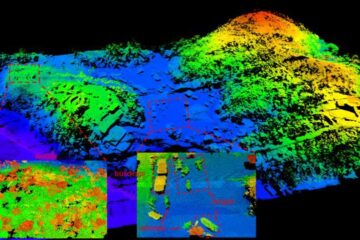

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…