European Capital Completes First One Stop Buyout

euro 29 Million Invested in Leading Producer in European Commercial Sushi Market

European Capital, S.A. SICAR announced today it has invested approximately euro 29 million in the One Stop Buyout of Marco Polo Foods, the leading producer in the European commercial sushi market. European Capital’s investment takes the form of senior term debt, senior subordinated debt, redeemable bonds and common equity. Marco Polo management is investing in redeemable bonds and common equity.

“Only six months after opening an office in France, we are very pleased to announce European Capital’s first One Stop Buyout, executed by our Paris office,” said Ira Wagner, President of European Capital Financial Services Limited (“European Capital Services”), the investment advisor of European Capital. “The buyout of Marco Polo Foods is a significant milestone in the development of our European franchise and France in particular. Since opening the Paris and London offices, we are seeing a very robust transaction pipeline. In addition, we are successfully bringing to bear our institutional capabilities to the European mid cap market, establishing a foundation for continued growth.”

European Capital has invested nearly euro 100 million in five companies since its formation in August of this year. For more information about European Capital, go to http://www.EuropeanCapital.com.

“We are investing in a company with a proven track record of growth as well as attractive future growth potential,” said European Capital Services Managing Director Jean Eichenlaub. “Marco Polo was the first to introduce and develop commercially produced high quality fresh and frozen sushi and created YEDO, the only established brand on the market. The Company also holds a worldwide patent for the rapid defrosting of sushi products. Marco Polo has proven that it has mastered the logistics of fresh sushi production, consistently delivering a quality product and meeting growing demand. It continues to innovate, now introducing a seven day shelf-life sushi product with the potential to expand the market further in Europe to hyper and super chains.”

“Retailers strongly support sushi because it is a relatively small product that requires limited shelf space yet generates high gross margins,” said Jacques Pancrazi, European Capital Services Director. “Marco Polo was the first company in France to make sushi available outside of Japanese restaurants and is now solidly positioned to lead the market as sushi consumption continues to rise.”

Marco Polo Foods was established in 1999 as the first commercial producer of fresh and frozen sushi products to the French and European retail markets. The Company’s ISO certified manufacturing facility is located approximately 100 miles south of Paris in Contres, France, where it operates from a top quality controlled newly built production site. The Company, which has consistently improved operating margins, currently has 120 employees producing more than 300,000 sushi per day.

“European Capital’s institutional capabilities and access to capital make it a very good investment partner for our business,” said Jean-Charles Halimi, Marco Polo founder and CEO. “We are pleased to know them and we welcome them as a partner as we grow the European market and develop our sushi concept for expansion to North America. This type of frozen sushi is not sold in American supermarkets and that presents us with opportunities for future development.”

ABOUT EUROPEAN CAPITAL

European Capital is a buyout and mezzanine fund with capital resources of euro 750 million. European Capital invests in and sponsors management and employee buyouts, invests in private equity buyouts and provides capital directly to private and mid-sized public companies. European Capital invests from euro 5 million to euro 125 million per transaction in equity, mezzanine debt and senior debt to fund growth, acquisitions and recapitalizations.

Companies interested in learning more about European Capital’s flexible financing should contact Jean Eichenlaub at +33-(0)-1-40-68-06-66 in Paris, Simon Henderson at +44-(0)-87-0351-6988 or Nathalie Faure Beaulieu at +44-(0)-87-0735-4184 in London, or visit our website at http://www.EuropeanCapital.com.

ABOUT AMERICAN CAPITAL

American Capital Strategies Ltd. (Nasdaq: ACAS), an affiliate of European Capital, is a publicly traded buyout and mezzanine fund with capital resources of approximately US$6.8 billion. American Capital invests in and sponsors management and employee buyouts, invests in private equity buyouts, provides capital directly to private and small public companies and through its asset management business is a manager of debt and equity investments in private companies. American Capital provides senior debt, mezzanine debt and equity to fund growth, acquisitions and recapitalizations.

As of October 31, 2005, American Capital shareholders have enjoyed a total return of 419% since the Company’s IPO — an annualized return of 22%, assuming reinvestment of dividends. American Capital has paid a total of US$868 million in dividends and paid or declared US$19.08 dividends per share since its August 1997 IPO at US$15 per share.

Performance data quoted above represents past performance of American Capital. Past performance does not guarantee future results and the investment return and principal value of an investment in American Capital will likely fluctuate. Consequently, an investor’s shares, when sold, may be worth more or less than their original cost. Additionally, American Capital’s current performance may be lower or higher than the performance data quoted above.

This press release contains forward-looking statements. The statements regarding expected results of American Capital Strategies are subject to various factors and uncertainties, including the uncertainties associated with the timing of transaction closings, changes in interest rates, availability of transactions, changes in regional, national or international economic conditions, or changes in the conditions of the industries in which American Capital has made investments.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

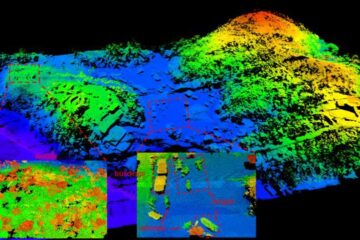

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…