Investors behave like ostriches in choosing bank deposits over t-bills

Do investors act like ostriches?

Why do people prefer to put their money into closed, interest-bearing bank deposits, when they could invest it in liquid, higher-yielding government treasury bills (T-bills) at no greater risk?

It’s all because of what Hebrew University of Jerusalem researchers Prof. Dan Galai and Dr. Orly Sade call the “ostrich effect” – that is, investors “burying their heads in the sand” like ostriches so as to ignore what they perceive as a risky situation.

Galai, the Abe Gray Professor of Business Administration, and Sade, both of the Hebrew University’s Jerusalem School of Business Administration, examined the savings habits of Israelis as well as Americans in this regard. Their findings will be published in a forthcoming issue of the Journal of Business, one of the world’s leading finance journals.

Galai and Sade found that during 1999 to 2002, government treasury bills in Israel provided a higher yield to maturity than interest-bearing, non-liquid, one-year bank deposits (after taking into account relevant transaction costs). Both types of investment offer the same level of low risk. They also found a similar type of return gap in the U.S. during February 2005.

Since the authors provide field data indicating that investors prefer to hold non-liquid assets and are willing to pay a premium for them, their findings are challenging the premise that one would generally expect to find: that people would normally accept a lower return in return for the benefit of liquidity.

The “return gap” documented in Israel cannot be attributed to taxes, risk or transaction costs. As a result the natural question to ask is why investors invest in one-year bank deposits if they can earn higher returns by investing in T-bills?

The authors explain the findings by using a psychological explanation — what they call the “ostrich effect” — attributing this seemingly anomalous behavior to an aversion to receiving information on potential interim losses. In this case the reference is to daily fluctuations in the value of T-bills, which are publicly traded and regularly reported upon in the media and in investors’ individual financial statements.

On the other hand, changes in bank savings interest are not generally publicly reported. Since these bank deposits are not marketed, loss-averse investors are able to ignore market information. Like ostriches, the investors don’t want to “see” what looks to them as a risky (T-bill) investment, even though the risk is minimal (treasury bills will always pay their stated return if held to maturity, regardless of price fluctuations) and is not greater than the risk involved in fluctuating interest rates for bank deposits.

The authors conclude that by and large, when faced with uncertain investments, many individuals prefer investments where the risk is unreported over similar investments (from the standpoint of risk-return) where the risks are frequently reported. This behavior ignores the fact that should the investor in the bank deposit require his money before the designated maturation date, he will suffer loss of interest and penalties for early withdrawal – which is not the case with selling the liquid T-bills.

As predicted by the ostrich effect, the authors find that the difference between the return on the liquid asset relative to the non-liquid asset is higher in periods of greater uncertainty in the financial markets.

Media Contact

More Information:

http://www.huji.ac.ilAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Simplified diagnosis of rare eye diseases

Uveitis experts provide an overview of an underestimated imaging technique. Uveitis is a rare inflammatory eye disease. Posterior and panuveitis in particular are associated with a poor prognosis and a…

Targeted use of enfortumab vedotin for the treatment of advanced urothelial carcinoma

New study identifies NECTIN4 amplification as a promising biomarker – Under the leadership of PD Dr. Niklas Klümper, Assistant Physician at the Department of Urology at the University Hospital Bonn…

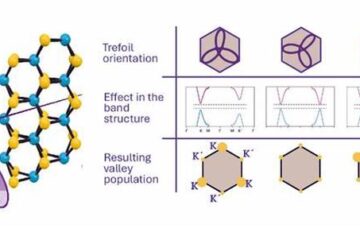

A novel universal light-based technique

…to control valley polarization in bulk materials. An international team of researchers reports in Nature a new method that achieves valley polarization in centrosymmetric bulk materials in a non-material-specific way…