Third quarter: Continued strong demand for KfW financing

In the first nine months of 2011, KfW Bankengruppe made commitments totalling EUR 52.9 billion, confirming the long-term trend of high and rising demand for KfW financing. The anticipated normalisation of the financing volume against the exceptional year2010 (same period last year: EUR 59.8 billion) has set in, a year that was marked by special effects such as the economic stimulus packages and pull-forward effects brought about by legal changes affecting several major promotional programmes (Renewable Energies, Energy Efficiency). Even with the solid economic development of 2011, demand for financing from KfW is still strong and significantly higher than the financing volume committed in the same period of 2009 (EUR 41.8 billion). KfW committed EUR 39.0 billion under its domestic financing programmes (same period last year: EUR 50.1 billion, 2009: EUR 33.2 billion). Demand for classic SME finance from KfW has remained stable and reached EUR 15.7 billion (EUR 16.4 billion) without the KfW Special Programme (economic stimulus programme). KfW's international business experienced a strong rise to EUR 13.7 billion against EUR 8.4 billion in the same period last year (2009: EUR 7.4 billion).

“2011 will be another successful year for KfW. The normalisation of the economic situation in the context of the ongoing acute financial crisis is leading to stronger demand for KfW's products. For the future, we are challenged to provide support particularly as a financier of the energy turnaround, which will require enormous investment and innovation. Financing it will primarily require long-term funds, which are becoming increasingly more difficult for the commercial banks to obtain because of the persistent sovereign debt crisis”, said Dr Ulrich Schröder, Chief Executive Officer of KfW Bankengruppe.

As at 30 September 2011, KfW Bankengruppe achieved a consolidated profit of EUR 1,806 million (EUR 1,481 million). The consolidated profit before IFRS effects from hedging* was EUR 1,548 million, less than the previous year's outstanding result of EUR 2,235 million, but nonetheless on an above-average level.

“KfW continued the very good development of results from the first half of the year. This will safeguard KfW's sustained promotional capacity, also with a view to the anticipated higher regulatory requirements. Nonetheless, this result again includes high positive contributions resulting from risk provisions and valuations that cannot be continued into the future”, said Dr Schröder.

The operating result before valuation was EUR 1,411 million. This good result was mostly due to the continued high net interest income of EUR 1,783 million (EUR 2,033 million), which is mostly due to KfW's continued favourable refinancing conditions. Interest rate reductions totalled EUR 421 million, slightly more than in the previous year.

Risk provisions for lending business developed very positively and could be reduced by a net total of EUR 260 million (EUR 285 million). The improved risk situation had a positive effect especially on export and project finance operations and the promotion of developing and transition countries.

The negative result of EUR 83 million (EUR 182 million in earnings) from the private equity and securities portfolio included charges for Greek government bonds with a nominal volume of around EUR 250 million, which had to be written down by EUR 137 million to their market value (to average prices of 45% at 30 September).

The purely IFRS-related effects from the valuation of derivatives used for hedging purposes amounted to EUR 258 million, increasing the valuation result considerably (expenses of EUR 754 million). This was mostly caused by reversal effects from the previous years and by interest rate developments in 2011. These positive earnings effects have decreased significantly by EUR 334 million against 30 June 2011 so that the consolidated profit of EUR 1,806 million was only slightly higher than the EUR 1,764 million at 30 June 2011.

The significant increases in the regulatory ratios, with a core capital ratio of 16.1% (previous year: 12.4%), can be primarily attributed to the higher regulatory capital resulting from the consolidated profit.

The results of KfW's promotional activities in detail

As expected, in the business area KfW Mittelstandsbank the volume of new business was lower than in the same period last year, at EUR 16.4 billion (EUR 21.8 billion). This was primarily due to the phase-out of the economic stimulus packages, particularly the KfW Special Programme, at the end of 2010. As a result, the volume of commitments in the priority area of business start-ups and general corporate finance fell from EUR 11.7 billion to EUR 7.6 billion. In the area of innovation finance, in turn, commitments increased from EUR 1.6 billion to EUR 2.0 billion. In the area of environmental protection the volume of commitments decreased from EUR 8.5 billion to EUR 6.9 billion. This was due to a decline in the demand for loans from the KfW Renewable Energies Programme to finance photovoltaic installations. Here commitments again normalised after the record volume of 2010 following the reduction of the feed-in tariff. Demand for loans under the ERP Environmental Protection and Energy Efficiency Programme, in turn, doubled to EUR 1.8 billion.

In the business area KfW Privatkundenbank the volume of commitments was EUR 11.4 billion, lower than in the third quarter of 2010 (EUR 15.5 billion). This decline was due to pull-forward effects in the previous year, particularly under the Energy-efficient Construction and Refurbishment Programme. In education finance the volume of commitments reached EUR 1.4 billion (EUR 1.4 billion). Demand for the KfW Student Loan grew at the start of the winter semester 2011/12, particularly as a result of the higher number of new students.

In the business area KfW Kommunalbank the volume of commitments was EUR 11.2 billion, slightly below the level of the same period last year (EUR 12.7 billion). At EUR 2.9 billion, steady demand was recorded in the general infrastructure financing programmes in 2011 as well (EUR 3.5 billion). Particularly for promotional loans on-lent through banks to municipal and social enterprises, demand was very strong and reached a volume of EUR 1.2 billion, substantially more than in the same period last year (EUR 0.6 billion). The contract volume for the general refinancing of promotional institutions of the federal states amounted to EUR 8.4 billion (EUR 8.8 billion).

In the business area of export and project finance, which KfW IPEX-Bank handles within KfW Bankengruppe, new business commitments totalled EUR 10.4 billion (EUR 5.3 billion). The business unit Power, Renewables and Water remained one of the main drivers of growth, accounting for EUR 1.7 billion (EUR 1.2 billion). This very good result was also supported by commitments of EUR 1.5 billion (EUR 0.5 billion) in the business unit Aviation and Rail and of EUR 1.4 billion (EUR 0.5 billion) in the Shipping business unit.

The EUR 0.4 billion (EUR 1.3 billion) committed in the first nine months in the area of asset securitisation and capital market-related products also resulted from the refinancing of export loans covered by federal guarantees but primarily from financings in the segment of commercial leasing and loan receivables.

In the business area promotion of developing and transition countries, KfW Entwicklungsbank committed some EUR 2.6 billion, matching the level committed in the same period last year. Around EUR 2 billion of this sum is recognised as Germany's official development assistance (ODA quota). KfW provided EUR 1.7 billion in own funds. The main focus of the commitments is on social infrastructure programmes, which account for around EUR 760 million. Commitments by DEG amounted to EUR 650 million, slightly more than the EUR 600 million committed in the same period last year. As in the first two quarters, the financial sector accounted for the greatest portion of new commitments.

As at 30 September 2011, KfW raised long-term funds for the equivalent of EUR 72.9 billion in the international capital markets. For the business year 2011 KfW is planning a funding volume of around EUR 80 billion.

** For the complete Press Release with the Key financial figures please go to www.kfw.de/kfw/en/KfW_Group/Press/Latest_News/Recent_Press_Releases

*Explanation of consolidated profit before IFRS effects from hedging: Under IFRS, derivatives must be recognised at fair value in the balance sheet even if they are not used for trading, as in the case of KfW, but to hedge interest and currency risks. The opposing valuation effects of the underlying on-balance transactions thus hedged can be reported only inadequately under IFRS and therefore lead to economically inappropriate temporary earnings effects in KfW's income situation. These effects offset each other in total in the course of the overall maturity of the hedged items. Service: An overview of the business and financial figures is available at http://www.kfw.de/pressmaterial – Presentations and Business Figures.

Pressekontakt:

KfW, Palmengartenstraße 5-9, 60325 Frankfurt Kommunikation (KOM) Tel. 069 7431-4400, Fax: 069 7431-3266,

E-Mail: presse@kfw.de, Internet: www.kfw.de/newsroom

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

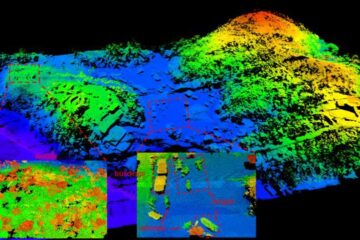

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…