KfW´s largest 10y USD Global due to Exceptional Demand

With this transaction, KfW has responded nimbly to both the current yield environment and strong investor demand for top-quality longer-dated assets in an environment of limited supply.

Dr. Günther Bräunig, member of the Managing Board of KfW Bankengruppe and in charge of capital markets commented: “It is not only the largest but probably the most successful 10 year USD-bond we have ever issued. We never had such tremendous interest from large international investors before.”

Settlement date of the bond is January 27th 2010 and it will mature on January 27th 2020. With a coupon of 4% p.a. and a reoffer price of 99.657% it yields 4.042% semi-annually. This corresponds to a yield pick-up of 38.5 basis points over the current ten-year US Treasury with maturity November 2019. The bond has an AAA/Aaa/AAA rating from Fitch Ratings, Moody's and Standard & Poor's as all KfW bonds have. Lead manager of the transaction are Goldman Sachs, JP Morgan und UBS; Co-Lead Managers are Bank of America / Merrill Lynch, Barclays, BNP Paribas, Citi, Deutsche Bank, HSBC, Morgan Stanley, Mitsubishi UFG, Nomura and Royal Bank of Canada CM.

The orderbook was opened on Tuesday London morning. Strong participation out of Asia resulted in an orderbook of over USD 3 bn after only a few hours. With the start of the US trading day on Tuesday there was continuous broad based demand from high quality US investors. Given the overwhelming demand, KfW was able to narrow the spread talk from mid swaps plus 30bp area to a range of 28bp to 30bp over mid swaps and decided to accelerate the close of books to noon New York time. The final orderbook amounted to a record volume of USD 6.33bn and enabled KfW to price a USD 4 bn transaction at the tight end of the price range at mid swaps plus 28. Until now, KfW has been the only non US Agency issuer able to sell 10-year global issues with such a success. “Since 2004 we have continuously offered long duration in USD global bonds, and we are now earning the benefits for our longtime commitment: investors appreciate the reliable issuance policy of KfW”, said Bräunig.

The final orderbook was well diversified and of extremely high quality with over 130 individual orders from investors around the globe. This again demonstrates the strong interest for the excellent credit risk of KfW, whose bonds are explicitly guaranteed by the Federal Republic of Germany, as well as their appreciation of KfW's USD strategy.

The breakdown of the order book by sectors is as follows:

Breakdown by investor type:

Banks: 35%

Central Banks: 34%

Funds: 30%

Others: 1%

Geographical Breakdown:

Americas: 42%

Asia: 34%

Europe: 21%

Middle East: 3%

KfW has announced a funding volume of EUR 70-75 bn for 2010. The Benchmark Programmes in EUR and USD will again account for the main share of the funds raised. With this transaction KfW has already reached circa 18% of its announced total funding volume for 2010.

Term Sheet KfW USD II/2010

USD 4 billion – 4.000% – 2010/2020

ISIN: US500769DP65

Issuer: KfW (Kreditanstalt für Wiederaufbau)

Guarantor: Federal Republic of Germany

Rating: AAA (Fitch Ratings)/Aaa (Moody's)/AAA (Standard & Poor's)

Size: USD 4,000,000,000.–

Maturity Date: 27th January 2010 – 27th January 2020

Coupon: 4.000% p.a., semi-annual coupon Payment Dates: January 27th and July 27th

Re-offer-Price: 99.657%

Yield: 4.042% semi-annually

Format: Global

Stock Market Listing: Luxembourg

Lead Managers (3):

Goldman Sachs

JP Morgan

UBS

Co-Lead Managers (10):

Bank of America / Merrill Lynch,

Barclays

BNP Paribas

Citi

Deutsche Bank

HSBC

Morgan Stanley

Mitsubishi UFG

Nomura Royal

Bank of Canada CM

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. KfW has registered the securities that are the subject of this press release for sale in the United States. The offering of the securities in the United States will be made by means of a prospectus that may be obtained from KfW and will contain detailed information about KfW and its management, financial statements and information about the Federal Republic of Germany.

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

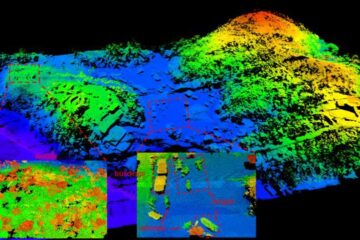

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…