Hedge fund share restrictions favor managers over investors

Armed with insider knowledge, managers of share-restricted hedge funds sell off their own holdings ahead of their investors in order to avoid low returns produced by an outflow of shareholder dollars, according to a new study by researchers from Boston College and EDHEC Business School in France.

The practice, known as front running, pits the interests of managers against those of investors in hedge funds where shareholder actions are limited by contract and there is scant disclosure of fund details. Managers act in advance on the information they possess, and can pass it along to preferred clients to shield them from declining returns, which the researchers say can be predicted by the flow of funds.

Analyzing rarely-seen data from the privately held funds, Boston College Professor of Finance Ronnie Sadka and EDHEC researcher Gideon Ozik identified 56 events where managers reduced their holdings, actions that were subsequently followed by a significant out flow of other investors' money. Further studying a larger sample of thousands of funds, the researchers conservatively estimated that managers in the hedge fund industry could have effectively sheltered approximately $2.4 billion dollars from reduced returns that Sadka and Ozik say are directly linked to the withdrawal of investor dollars from a hedge fund.

The findings follow a number of high profile cases in recent years that spotlight managers of the multi-billion dollar funds who shielded their own holdings from losses or tipped off preferred clients in advance of an investor's departure from a fund. Earlier this month, billionaire hedge-fund manager Philip Falcone's Harbinger Capital Partners was accused of providing preferential treatment to Goldman Sachs and other investors.

“The evidence suggests that private information about a fund, not only about the fundamental value of its assets, may constitute material information,” report Sadka and Ozik. “Such private information engenders potential conflict of interest between fund managers and investors, with implications for proper fund governance and disclosure policy concerning managerial actions.”

In share-restricted hedge funds, investors' actions are limited in order to protect the common interests of all investors in a fund. The restrictions, such as lockup periods or redemption-notice periods, provide an incentive to retain assets in a fund, allow managers to slowly acquire or sell positions and reduce the impact of trading-induced price pressures.

But these share restrictions produce a lopsided exchange of information between managers and their clients about future fund flows, said Sadka.

“We found that flow predicts returns, so the fund manager who receives the three- or six-months notice an investor plans to withdraw their stake possesses an information advantage on which they can act or communicate to other clients,” said Sadka. “The fund manager can pull his or her stake out of the fund, or allow other investors out of the fund. The investor who is not informed is left out in the cold.”

Focusing on share-restricted hedge funds between 1999 and 2008, Sadka and Ozik found that funds with recent inflows on average earned an additional 5.6 percent annually compared to funds that experienced outflows. No such return spread was observed for funds with fewer share restrictions. So regardless of the fund's assets or strategic approach, the basic knowledge about the flow of funds offers powerful incentive for both managers and investors in share-restricted funds to sell shares, the co-authors report.

Contrary to mutual funds, where investors can remove funds at any time and other investors can see changes in the net value of the fund, share-restricted hedge fund managers must receive several months advance notice before an investor can withdraw. That provides managers with opportunity to withdraw their own stake in advance of the outflow of funds.

“This raises a lot of issues about incentives and information,” said Sadka. “All of a sudden, not all investors are equal in a fund. Even information about a fund itself, whether money is flowing in or out, could be material information because that is a reliable predictor of returns.”

Sadka and Ozik also compared the effect of managerial capital reductions on high-governance funds – typically audited, US-based funds that report to regulators – and low-governance funds, which are located offshore, do not report audit results or file with regulators. The added disclosure measures produced dramatically different responses by managers to the outflow of funds.

The researchers found that outflows following managerial capital reductions were larger among low-governance funds, reaching a rate of about 18 percent within a year, while the outflow rate hovered at approximately 6 percent for high-governance funds.

To counter these findings, Sadka said hedge-fund managers should disclose their intention to subscribe to or redeem shares from the funds they manage to avoid the appearance of front-running their lesser-informed investors. In addition, imposing tighter share restrictions on managers and insiders should be considered. Finally, in light of these findings, managers and investors should consider that private information about a fund – not just fundamental asset values – may constitute material information.

Media Contact

More Information:

http://www.bc.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

How evolution has optimised the magnetic sensor in birds

The magnetic sense of migratory birds is probably based on the protein cryptochrome 4, and a genetic study has now provided further support for this theory. A team of researchers…

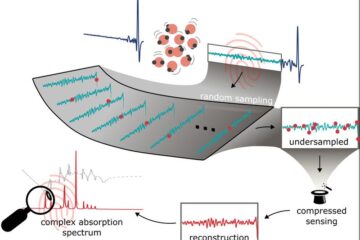

Molecular Fingerprint Beyond the Nyquist Frequency

Ultrafast laser spectroscopy allows the ascertainment of dynamics over extremely short time scales, making it a very useful tool in many scientific and industrial applications. A major disadvantage is the…

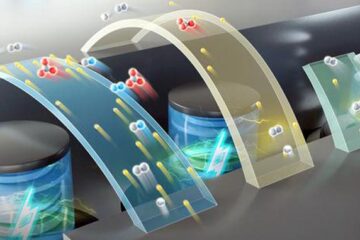

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…