Successful start to KfW's 2009 business year

Dr Schröder: “After two difficult and costly years, KfW is back to earning profits. The income earned from current operations in the first quarter is very encouraging. This development gives us the strength we need to continue intensifying our promotion in the current recessionary phase and to put all our energy to work in fulfilling our tasks under the economic stimulus package.”

After two difficult years of heavy losses resulting from the IKB rescue and the crisis of financial markets, KfW is back to earning profits in the first quarter of 2009. The interim accounts of the KfW Group according to IFRS as at 31 March 2009 closed with a consolidated profit of EUR 80 million.

The operating result before valuation developed particularly favourably at EUR 660 million, as compared with EUR 359 million in the same period of 2008. KfW was able to benefit from the sharp decline in interest rates in the money and capital markets. The result was reduced by EUR 157 million from the valuation of derivatives which were used solely to hedge risks.

This effect, which is purely a result of the fair value principle applied under IFRS, does not constitute a financial burden for KfW.

KfW takes this effect into account in its report of a consolidated profit before hedging, which was EUR 237 million in the first quarter of 2009. The result reported in KfW's individual financial statements, prepared in accordance with the German Commercial Code, is on a similar level.

Dr Ulrich Schröder, Chairman of the Managing Board of KfW Bankengruppe, said: “KfW possesses a functioning business model, and our outstanding result from current operations in the first quarter of 2009 demonstrates this forcefully. After the two previous years, which closed with a high loss particularly as a result of the rescue of IKB and the financial market crisis, we can now return to focusing fully on our promotional mission. Given the difficult economic times we are going through, this is more important than ever before.”

The negative impacts from the financial and economic crisis were clearly less pronounced in the first quarter of 2009 than in the previous year. The risk situation in the lending business has turned out to be stable considering the difficult economic environment, and the volume of business is growing. The conservative risk provisions were increased by EUR 0.2 billion, reflecting the increasingly more difficult lending environment. Furthermore, charges of roughly EUR 0.2 billion resulted from securities of some EUR 40 billion in the Group's portfolio.

The volume of business rose by 4.8% since 31 December 2008 (EUR

454.1 billion) to EUR 475.8 billion. However, the growth also resulted from the funding volume, which was disproportionately high for the beginning of a year, and which was successfully implemented this year as well in spite of the difficult financial market situation.

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Corporate News

Newest articles

Trotting robots reveal emergence of animal gait transitions

A four-legged robot trained with machine learning by EPFL researchers has learned to avoid falls by spontaneously switching between walking, trotting, and pronking – a milestone for roboticists as well…

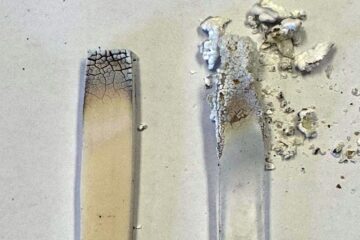

Innovation promises to prevent power pole-top fires

Engineers in Australia have found a new way to make power-pole insulators resistant to fire and electrical sparking, promising to prevent dangerous pole-top fires and reduce blackouts. Pole-top fires pose…

Possible alternative to antibiotics produced by bacteria

Antibacterial substance from staphylococci discovered with new mechanism of action against natural competitors. Many bacteria produce substances to gain an advantage over competitors in their highly competitive natural environment. Researchers…