Exchange rates have little impact on UK export levels

Changes in exchange rates have little impact on UK manufacturing exports and are likely to have only a modest effect in reducing the country’s record trade deficit, researchers at GEP — the Globalisation and Economic Policy Centre at The University of Nottingham — claimed today.

The researchers analysed exchange rate movements and export patterns of over 23,000 UK manufacturing firms over a 17-year period from 1987 to 2004 — the most comprehensive research of its kind carried out here.

In a paper to be presented at the Royal Economics Society Annual Conference next week, the GEP team say that changes in exchange rates have no impact on a manufacturer’s decision over whether to start — or stop — exporting.

Report co-author, Dr Richard Kneller, Associate Professor of Economics at The University of Nottingham, where GEP is based, said: “Our research shows that a drop in the value of the pound will not suddenly persuade British manufacturers to get out their foreign phrase books and start trying to sell overseas.“

He said the analysis also showed that changes in exchange rates make no difference to the level of exports of multi-nationals based in the UK.

Dr Kneller said: “It would appear that multi-nationals are better able to internalise and offset currency risks. In the last few years there has been a huge amount of foreign direct investment in the UK, which means that multi-nationals now account for at least a third of total UK exports.”

But the report shows that exchange rates do have some effect on individual domestic UK manufacturers. For every one per cent increase in an exchange rate index a firm’s exports will drop by 1.28 per cent. Usually exchange rate indices change by between three and 10 index points in a year.

But Dr Kneller said: “You have to put this into context — on average, exports account for just 5.6 per cent of a domestic UK manufacturers business — so, on average, a ten point change in the exchange rate index will make about half a per cent difference to total sales for a firm.

“The findings may surprise many people — intuitively you would expect a strong pound to be bad for exports and a weak pound to lead to much greater exports, but this research shows a different picture. It means those concerned about the size of the trade deficit should not see a devaluation of sterling as a magic bullet solution to closing the gap.”

Media Contact

More Information:

http://www.nottingham.ac.ukAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Trotting robots reveal emergence of animal gait transitions

A four-legged robot trained with machine learning by EPFL researchers has learned to avoid falls by spontaneously switching between walking, trotting, and pronking – a milestone for roboticists as well…

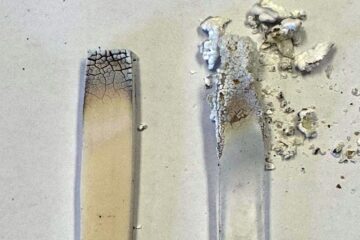

Innovation promises to prevent power pole-top fires

Engineers in Australia have found a new way to make power-pole insulators resistant to fire and electrical sparking, promising to prevent dangerous pole-top fires and reduce blackouts. Pole-top fires pose…

Possible alternative to antibiotics produced by bacteria

Antibacterial substance from staphylococci discovered with new mechanism of action against natural competitors. Many bacteria produce substances to gain an advantage over competitors in their highly competitive natural environment. Researchers…