The Impact of Owners in Mergers & Acquisitions

In the U.S. alone, deals announced in the last decade amount to more than $10 trillion. Yet analysis of M&A research concludes that — on average — mergers and acquisitions fail to create value for the owners of the acquiring firm in the short term.

Intrigued by the question of why managers pursue such deals even when they do not improve shareholder wealth, Dharwadkar, Brandes, and Goranova examined the implications of ownership from a novel perspective. In their paper “Owners on Both Sides of the Deal: M&A and Overlapping Institutional Ownership,” in Strategic Management Journal, they investigated the consequences of “overlapping” institutional ownership — whereby owners may have simultaneous stakes in both the acquirer and the target to an M&A deal. They further studied whether the negative effect of overlapping ownership is constrained by better corporate governance as measured by level of board independence, CEO duality (when the CEO also serves as chairman of the board), managerial ownership, and CEO stock options.

They found that the shareholder losses in acquiring firms were clearly related to the level of overlapping ownership:

• In M&A deals where there was no overlapping institutional ownership, the acquiring firm value went down by $1.6 million. In contrast, in deals where there were overlapping ownership stakes, the acquiring firm value fell by $111.7 million.

• Interestingly, a further examination of the overlapping deals revealed that those with less overlap (the bottom 25% of deals) were associated with a loss of $80.7 million for the acquiring firm. In stark contrast, deals with significant overlap (the top 25% of overlapping deals) was associated with an average loss of $379.8 million for acquirers.

The trio found that these results held true for two measures of overlap: both the number of overlapping owners involved in the deals as well as the percentage of ownership overlap. While the spread of overlapping ownership is associated with suboptimal M&A deals, effective oversight by boards constrains the negative effect of overlapping ownership. Specifically, boards with more independent directors and those having chairmen separate from the CEO role can counteract the effect of overlapping owners. The authors conclude that managers pursue suboptimal deals because overlapping and nonoverlapping owners have different interests in such deals–that overlapping owners who may lose on the acquirer’s side may make up for this loss on the target’s side of the deal.

“Our study raises the question of whether disclosure of overlapping ownership is warranted,” says Dharwadkar.

Amy Schmitz, director of communications, Whitman School of Management, Syracuse University, (315) 443-3834, aemehrin@syr.edu

AUTHORS: Ravi Dharwadkar, professor of management, Pamela Brandes, associate professor of management, and Maria Goranova ’07 PhD, assistant professor in the Lubar School of Business at the University of Wisconsin—Milwaukee

Media Contact

More Information:

http://www.syr.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

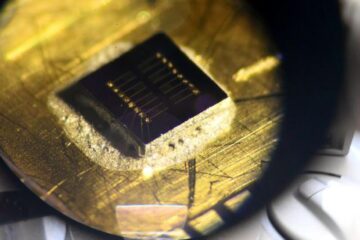

Sea slugs inspire highly stretchable biomedical sensor

USC Viterbi School of Engineering researcher Hangbo Zhao presents findings on highly stretchable and customizable microneedles for application in fields including neuroscience, tissue engineering, and wearable bioelectronics. The revolution in…

Twisting and binding matter waves with photons in a cavity

Precisely measuring the energy states of individual atoms has been a historical challenge for physicists due to atomic recoil. When an atom interacts with a photon, the atom “recoils” in…

Nanotubes, nanoparticles, and antibodies detect tiny amounts of fentanyl

New sensor is six orders of magnitude more sensitive than the next best thing. A research team at Pitt led by Alexander Star, a chemistry professor in the Kenneth P. Dietrich…