Study Identifies Causes of Executive Turnover after M&As

The study, “Brain Drain: Why Top Management Bolts After M&As,” analyzes factors that can lead to abnormally high turnover rates among target company executives – turnover that may continue for 10 or more years after the acquisition.

The new research examines a range of factors that can promote long-term leadership instability such as merger characteristics, the nature of merger negotiations, growth and profitability of the target company, headquarters location of the acquirer – whether foreign or domestic – and the foreign investment experience of the acquirer.

“Most firms involved in merger integration understand the importance of reestablishing an effective top management team after an acquisition,” said Jeffrey A. Krug, Ph.D., associate professor of strategic management in the VCU School of Business and author of the study, which appears in Vol. 30, issue 6, November/December issue of the journal. “However, few firms understand the causes of long-term executive turnover after a deal and how to manage it.”

Among Krug’s findings:

– The nature of merger negotiations is especially critical. Unfriendly negotiations, for instance, “create ill feelings among incumbent executives that often spill over to executives who join the firm years later.”

– Poor performance in target companies before an acquisition foreshadows higher-than-normal executive turnover rates that can last 10 or more years after a deal. This suggests that poor performance and leadership instability can become embedded in a firm’s culture. Improving performance in the firm becomes a difficult task for an acquirer when such leadership instability exists.

– Cross-border transactions slow the integration process. Foreign acquirers tend to take the first two years following the deal to observe the target’s operations before initiating major strategic changes; domestic acquirers move more quickly.

“Brain Drain” follows Krug’s 2008 study, “The Big Exit: Executive Churn in the Wake of M&As,” also published in the Journal of Business Strategy (Vol. 29, Issue 4, July/August 2008). This study analyzed patterns of target company executive turnover in more than 1,000 firms and demonstrated that many mergers and acquisitions destroy leadership continuity in target companies’ top management teams for at least a decade following the deal.

Complete copies of both “The Big Exit” and “Brain Drain” are available at http://www.emeraldinsight.com/jbs.htm, the web site of the Journal of Business Strategy, published by Emerald Group Publishing Limited.

About VCU and the VCU Medical Center: Virginia Commonwealth University is the largest university in Virginia with national and international rankings in sponsored research. Located on two downtown campuses in Richmond, VCU enrolls 32,000 students in 205 certificate and degree programs in the arts, sciences and humanities. Sixty-five of the programs are unique in Virginia, many of them crossing the disciplines of VCU’s 15 schools and one college. MCV Hospitals and the health sciences schools of Virginia Commonwealth University compose the VCU Medical Center, one of the nation’s leading academic medical centers. For more, see www.vcu.edu.

About Emerald: Established in 1967, Emerald Group Publishing is the world’s leading publisher of management research. In total, Emerald publishes over 700 titles, comprising 200 journals, over 300 books and more than 200 book series as well as an extensive range of online products and services. Emerald is both COUNTER and TRANSFER compliant. The organization is a partner of the Committee on Publication Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation. Emerald Management Plus is the largest, most comprehensive collection of peer reviewed management journals and online support for students, managers and researchers. With “Research you can use” as a publishing philosophy, the collection provides scholarly research that is both rigorous and relevant, with practical implications for professionals outside the academic world. For busy managers in corporate, federal and public organizations, Emerald Management First is an award-winning online knowledge and information resource.

Media Contact

More Information:

http://www.vcu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

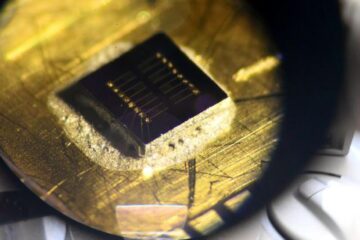

Sea slugs inspire highly stretchable biomedical sensor

USC Viterbi School of Engineering researcher Hangbo Zhao presents findings on highly stretchable and customizable microneedles for application in fields including neuroscience, tissue engineering, and wearable bioelectronics. The revolution in…

Twisting and binding matter waves with photons in a cavity

Precisely measuring the energy states of individual atoms has been a historical challenge for physicists due to atomic recoil. When an atom interacts with a photon, the atom “recoils” in…

Nanotubes, nanoparticles, and antibodies detect tiny amounts of fentanyl

New sensor is six orders of magnitude more sensitive than the next best thing. A research team at Pitt led by Alexander Star, a chemistry professor in the Kenneth P. Dietrich…