Mobile payments for anything, anywhere, at all times

Do you need to contact your bank to find out whether a payment has been made or would you like to make a purchase? How about using your mobile phone or PDA to access these services wherever you are? This is now possible, thanks to a secure mobile, universal real-time payment service.

The SEMOPS IST programme-funded project is a pioneer in mobile payment methods. This open, secure mobile payment service is based on a cooperative model between banks and mobile network operators.

Project partners from 15 companies and banks across Europe overcame obstacles of universality, security and cost, and created a business model that provides for a general purpose payment service that can be used by anyone, for anything, anywhere at all times.

SEMOPS meets market challenges

Previously, no comprehensive payment solution was available. SEMOPS is expected to create considerable market demand for a secure solution that serves multiple purposes simultaneously, allowing consumers several options for making payments using mobile devices. These include person-to-person payment, mobile phone top-up, bill and invoice payment, use of mobile phones as virtual points-of-sale (POS), and payment at POS terminals using a mobile phone, as well as payments at vending machines, parking facilities and over the Internet.

The lack of security and adequate technology also created obstacles to developing a universal payment service. Another obstacle was the lack of business cooperation between mobile operators and banks.

“SEMOPS created a business model that facilitates the cooperation and revenue share between mobile operators and banks,” project manager András Vilmos explains. “The application of Java-GPRS technology provides technical independence for the business providers from the mobile operators, which allows for a more balanced cooperation.”

Using existing infrastructure, high level security and full automation minimises costs, which also makes the SEMOPS solution attractive to mobile operators, banks, merchants and ultimately, consumers.

Using Java handsets and GPRS communications technology, SEMOPS developed secure, user-friendly solutions. More traditional technology is supported, however, its use compromises usability and speed.

The various modules are either SIM card-based applications, Java applets, or programs embedded in the operating systems of the handsets. The back end infrastructure – banking and data center functionality – is a Java program.

High level security

Vilmos claims SEMOPS is “very secure” because of a multi-layer security architecture. Customers are in full control of the payment process and they individually approve each transaction. They only provide sensitive information, their PIN, to their trusted partners, the payment processors. As a result, no unknown third party is involved.

“This means their personal information cannot be misused,” he says. “Each transaction is individually approved and initiated by the customers. All sensitive date is encrypted during communication and all bank information is digitally signed.”

Merchants receive a bank guarantee for all payments received. As a result, they do not need to know or identify their customers, just as in a cash purchase, because the collection risk is eliminated. There is no central data storage and it is impossible for third parties to clone any transaction.

Security experts at project partner Deloitte Touche conducted a two-phase complex security audit of the SEMOPS payment service. Vilmos reports that no major security issues were discovered and SEMOS is expected to receive its security clearance in the next few weeks.

An open business model holds potential

The SEMOPS payment service establishes cooperation between banks and mobile operators. Because the service is based on bank accounts or accounts maintained by mobile operators, the potential customer base is far greater than that of existing solutions. Whole new market segments and sectors can be accessed with this new payment method.

The service is provided to end users – customers and merchants – by their local payment processors, which are the banks for macro payments and mobile operators for micro transactions. The banks, mobile operators and local payment processors determine the service structure, the fee structure and fee level bilaterally.

“The business model is open,” Vilmos explains. “Any bank or mobile operator can be a payment processor and offer the service to its clients. Merchants can cover all potential markets and customers have access to any merchants they want. In addition, payment processors structure their own service offering and conditions under their own known brand.”

SEMOPS has a relatively low cost structure due to its fully automated operations, the use of existing infrastructure, the high level of security and the use of the most cost efficient communications channels.

SEMOPS benefits all participants

As the only real-time, universal mobile payment service, SEMOPS benefits all participants.

Customers benefit from a cash free payment that can be used in practically any type of payment situation at a large number of merchants. Using the same menu system and commands, payments can be performed for anything on the Internet or on a mobile channel. The primary benefit is security and trust in knowing that personal data and privacy are protected.

Merchants have lost business opportunities due to the lack of an adequate payment solution. Many consumers were put off by e-commerce because of the long, tedious processes involved and the amount of data required when paying. SEMOPS opens new markets for merchants with new customers. Collection security will decrease the cost of sales. Rates are lower than existing services.

SEMOPS means a new sales channel for banks that will increase the numbers of transactions, turnover and revenues. Bank do not have to launch their own electronic payment solution but can join forces with each other and mobile operators to introduce a service with limited risk and lower expenses. Because SEMOPS is primarily based on existing banking procedures and infrastructure, integration is simple and can improve efficiency.

Because they are infrastructure providers, SEMOPS allows mobile operators to move up the value chain to become value generators. By participating in transaction processing, they can establish a new revenue source. As a result of this new payment service, numerous new products and services will appear on the market.

Pilots involving Greek and Hungarian banks are underway, however, Vimos says banks are, “difficult because they have a cautious approach to new technology and new services”. However, SEMOPS, one of the largest mobile-based IT projects co-funded by the European Community, has a bright future – it will start deployment across Europe by 2006.

Media Contact

More Information:

http://istresults.cordis.lu/All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Targeted use of enfortumab vedotin for the treatment of advanced urothelial carcinoma

New study identifies NECTIN4 amplification as a promising biomarker – Under the leadership of PD Dr. Niklas Klümper, Assistant Physician at the Department of Urology at the University Hospital Bonn…

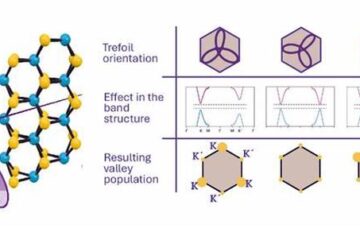

A novel universal light-based technique

…to control valley polarization in bulk materials. An international team of researchers reports in Nature a new method that achieves valley polarization in centrosymmetric bulk materials in a non-material-specific way…

How evolution has optimised the magnetic sensor in birds

The magnetic sense of migratory birds is probably based on the protein cryptochrome 4, and a genetic study has now provided further support for this theory. A team of researchers…