New Insights on the Factors That Intensified the 2008 Financial Crisis

Widespread finger–pointing in the fallout from the 2008–2009 financial crisis is only exacerbated by the continuing legal battles between the big banks and SEC. Fair value accounting (FVA) is often cast as the culprit for accelerating the economic downturn, but a new study from Columbia Business School, published in the Journal of Accounting and Public Policy, examines FVA’s role in the financial crisis and considers the advantages it offers relative to other methods of accounting.

“Fair value accounting has been blamed for the near collapse of the US banking system,” said Urooj Khan, assistant professor of accounting at Columbia Business School and co–author of the research. “On one hand, FVA can provide timely and relevant information during crisis, but it can feel like ripping off a Band–Aid causing immediate pain as it accelerates the process of price adjustment and resource reallocation in times of financial turmoil. On the other hand, it can increase contagion among banks by potentially fueling fire sales. Our research demonstrates that investors’ concerns about FVA’s detrimental affect overshadowed the beneficial role it plays in promoting timely market information.”

The study, titled “Market reactions to policy deliberations on fair value accounting and impairment rules during the financial crisis of 2008-2009,” was co–authored by Professor Urooj Khan of Columbia Business School and Professor Robert M. Bowen of the University of San Diego’s School of Business Administration and the University of Washington’s Foster School of Business. The researchers explore stock market investors and creditors reactions to events (such as policy deliberations, recommendations, and decisions) related to the relaxation of FVA rules during a period of extreme financial turmoil—September 2008 to April 2009.

The research found that while news about relaxing FVA rules generally led to positive stock market reactions, results varied depending on a variety of bank characteristics. The research also revealed additional takeaways that call into question FVA’s role in the recent financial crisis:

- Investors acted as if FVA rules harmed banks and accelerated their decline, resulting in a favorable reaction to discussions about relaxing FVA rules.

- There is some evidence that banks that were more susceptible to contagion are the ones that benefited the most from the change in FVA rules.

- For banks without analyst coverage, investor reactions to relaxed FVA rules were less positive, suggesting that, in the absence of other information sources, investors perceive FVA data as providing timely and informative disclosures about banks’ financial soundness.

- Banks with a higher proportion of illiquid assets saw a more positive stock price reaction to potential relaxation of FVA rules.

Khan and Bowen examined investor and creditor reactions to 10 events—including policymaker deliberations, recommendations, and decisions—related to the relaxation of FVA and impairment rules in the banking industry.

To complement the event analysis, the study also investigated cross–sectional stock price reactions to bank–specific factors that potentially contributed to the financial crisis’ spread. Factors analyzed included whether banks were well capitalized, their proportion of fair value assets, and the availability of information sources other than FVA data.

The research sample includes the 288 US bank holding companies that file the FR Y–9C report and have financial data available on the Bank Holding Companies Database maintained by the Federal Reserve Bank of Chicago, in addition to having stock price data on the Center for Research in Security Prices (CRSP) for the 6–month period of analysis from September 2008 to April 2009—a period in which regulators faced intense political pressure to relax FVA.

To learn more about the cutting–edge research being conducted at Columbia Business School, please visit www.gsb.columbia.edu.

###

Columbia Business School is the only world–class, Ivy League business school that delivers a learning experience where academic excellence meets with real–time exposure to the pulse of global business. Led by Dean Glenn Hubbard, the School’s transformative curriculum bridges academic theory with unparalleled exposure to real–world business practice, equipping students with an entrepreneurial mindset that allows them to recognize, capture, and create opportunity in any business environment. The thought leadership of the School’s faculty and staff, combined with the accomplishments of its distinguished alumni and position in the center of global business, means that the School’s efforts have an immediate, measurable impact on the forces shaping business every day. To learn more about Columbia Business School’s position at the very center of business, please visit www.gsb.columbia.edu.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Targeted use of enfortumab vedotin for the treatment of advanced urothelial carcinoma

New study identifies NECTIN4 amplification as a promising biomarker – Under the leadership of PD Dr. Niklas Klümper, Assistant Physician at the Department of Urology at the University Hospital Bonn…

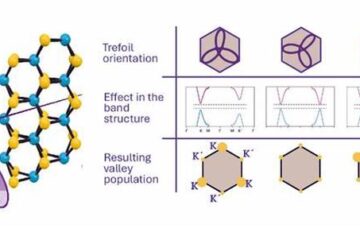

A novel universal light-based technique

…to control valley polarization in bulk materials. An international team of researchers reports in Nature a new method that achieves valley polarization in centrosymmetric bulk materials in a non-material-specific way…

How evolution has optimised the magnetic sensor in birds

The magnetic sense of migratory birds is probably based on the protein cryptochrome 4, and a genetic study has now provided further support for this theory. A team of researchers…