Insolvency risk lower for private equity-backed companies

Private Equity and Insolvency compares the failure rates of 140,000 private equity-backed and non-private equity backed businesses between 1995 and 2009.

The results show that buy-outs are more prone to failure than other types of companies, but that the risk of failure is significantly reduced if private equity companies are involved.

The research was carried out by the Centre for Management Buyout Research at Nottingham University Business School, the Credit Management Research Centre at Leeds University Business School, and The Entrepreneurship and Innovation Centre University of Birmingham Business School, and was commissioned by the British Private Equity and Venture Capital Association (BVCA).

Other key findings of the report include:

• Private equity involvement significantly reduces the risk of buyout failure;

• Private equity owned companies, due to the more hands on approach of private equity firms over the period, have over twice the debt recovery rate compared to publicly owned companies;

• Leverage levels do not distinguish between buyouts that fail from those that survive. The distinguishing feature is how the companies are managed and their ability to generate cash;

• PLC non-executive directors appear generally less involved than boards in private equity-backed buyouts when restructuring becomes necessary. PLCs can face greater problems in injecting new cash as they need to issue a formal investment proposal;

• Private equity firms select the best opportunities in terms of a company’s prospective profitability, ability to generate cash and therefore cover the interest on debt;

• Private equity-backed buyouts have a significantly better coverage ratio (the ability to pay interest on debt from profit and cash-flow) than non-private equity backed businesses.

“These are important findings in the context of the current policy debates surrounding private equity ownership,” said Professor Mike Wright of Nottingham University Business School.

“Our finding on the impact of leverage is counter to popular perceptions about private equity ownership. Private equity firms seem to select the best opportunities from the buyout population in terms of the company's prospective profitability and ability to cover interest and, where problems emerge, private equity firms appear to be more effective at structuring solutions to debt problems.”

Nick Wilson, Professor of Credit Management at Leeds University Business School, said: “This study analysed the insolvency rates of the UK corporate sector up to and including the recession and the peak of corporate insolvencies. We find that private equity-backed buyouts do not have a higher failure rate than other companies and, indeed, show a lower incidence of financial distress than other types of company buy-outs.

“Although leveraged, private equity-backed buyouts generate sufficient cash to cover interest payments and show adequate coverage ratios. Moreover, there is evidence that stakeholders in private equity backed deals are proactive in helping their portfolio companies deal better and more timely with trading and/or financing difficulties, particularly in the more recent period leading up to the credit crunch.”

Media Contact

More Information:

http://www.nottingham.ac.ukAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

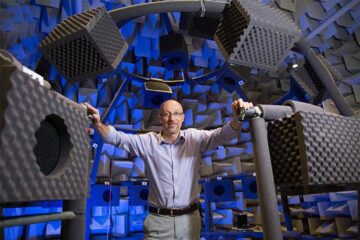

Why getting in touch with our ‘gerbil brain’ could help machines listen better

Macquarie University researchers have debunked a 75-year-old theory about how humans determine where sounds are coming from, and it could unlock the secret to creating a next generation of more…

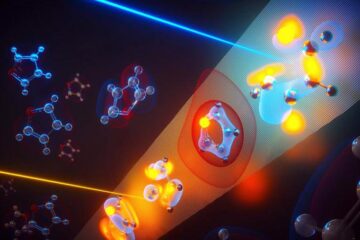

Attosecond core-level spectroscopy reveals real-time molecular dynamics

Chemical reactions are complex mechanisms. Many different dynamical processes are involved, affecting both the electrons and the nucleus of the present atoms. Very often the strongly coupled electron and nuclear…

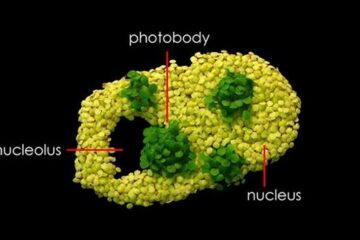

Free-forming organelles help plants adapt to climate change

Scientists uncover how plants “see” shades of light, temperature. Plants’ ability to sense light and temperature, and their ability to adapt to climate change, hinges on free-forming structures in their…