KfW defies challenging market

In the first half of 2008 KfW successfully defied the very volatile international capital markets with its funding strategy. This was stated by Dr. Frank Czichowski, treasurer of KfW Bankengruppe, at today's press conference in London on the German credit institution's capital market activities.

KfW funds its promotional lending business by issuing debt instruments, and at the end of 2007 it had expected funding needs of around EUR 70 billion for this year. Despite good news from the German economy, the market environment has been considerably more difficult than in the past as a result of the financial market crisis with all the related turbulence and pronounced volatility. “A flexible and transparent funding strategy has always been KfW's trademark; beyond this the key to success this year lies in diligent timing for debt issues as well as in choosing the proper maturity, and in what has been confirmed by market observers to be a wary and fair pricing of KfW securities”, explained Czichowski.

In the first six months of this year KfW has already raised EUR 46.9 billion in over 200 individual transactions in 22 different currencies; this is the liveliest funding activity ever in a comparable period of time. The main currencies were the euro (16.9 billion, 36%) the US dollar (equivalent of EUR 16.7 billion, 36%) and the pound sterling (equivalent of more than EUR 8.3 billion, 18%), which has firmly established itself as the third core currency.

Eight benchmark bonds were issued in the first half alone. In the euro segment a 3-year and a 10-year benchmark were issued in a volume of EUR 5 billion each. In the USD segment KfW issued global bonds of 3-, 5- and 10-years twice, with volumes of no less than USD 3 billion each. Thus, more than 50% of the funding in the first six months is made up of large-volume and highly liquid benchmark bonds in euros and US dollars in the equivalent of around EUR 23.8 billion. “Our benchmark programmes have proven their value as the most important pillar of our funding strategy. In the difficult current market environment international investors appreciate KfW's first-class credit quality, and they can rely on the performance of our bonds”, declared Czichowski.

Furthermore, the five-year bond exchangeable into ordinary stock of Deutsche Telekom AG which was issued in May received great attention, successfully continuing the federal government's and KfW's privatisation of the enterprise. This issue aroused great interest among institutional investors and also impressed many market players with its volume of EUR 3.3 billion.

Premature repayment of USD bonds and follow-up financing increases funding volume slightly to around EUR 75 billion

The mid-year review of annual funding needs performed regularly by KfW has led to a slight increase in the funding volume from around EUR 70 billion to now EUR 75 billion. “As the interest level has declined, particularly in the USA, this year there will be increasingly more premature repayments of callable US dollar bonds. We plan to make follow-up funding transactions for these bonds. This will slightly increase our funding needs by a total of around EUR 5 billion”, explained KfW's treasurer.

Looking back on the successful first half of the year Czichowski expressed optimism that KfW will well manage the funding of the remaining approximately EUR 28 billion. The focus of KfW's international capital market activities will continue to be the euro and the US dollar; the pound sterling, the Japanese yen and numerous niche currencies in which KfW offers investors debt instruments will also play their important part in the funding.

A strategically important novelty was introduced by KfW in the first quarter of this year by adopting sustainability criteria in the management of its own financial investments. The bank had committed itself to apply these criteria by signing the UN Initiative “Principles for Responsible Investment” (UN-PRI). KfW now bases its investment decisions for its own liquidity portfolio not only on the still important credit quality criterion but also on a sustainability rating and gives preference to issuers that meet the sustainability criteria established by KfW. In preparing this rating KfW cooperates with the sustainability rating agency “Scoris GmbH”.

“Sustainability as a central theme that guides the promotional activities and KfW Bankengruppe itself has thus also found its way into our capital market activities. We also hope that this step will further enhance the acceptance and implementation of the UN-PRI within the investment industry”, said Czichowski.

For more information on KfW's funding and sustainable financial investment management please go to http://www.kfw.de/EN_Home/Presse/Press_Conferences/index.jsp and http://www.presseportal.de/go2/Socially_responsible_investment

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

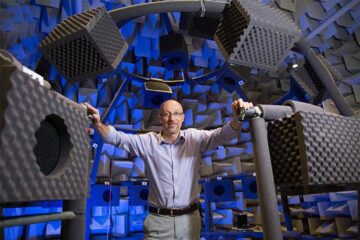

Why getting in touch with our ‘gerbil brain’ could help machines listen better

Macquarie University researchers have debunked a 75-year-old theory about how humans determine where sounds are coming from, and it could unlock the secret to creating a next generation of more…

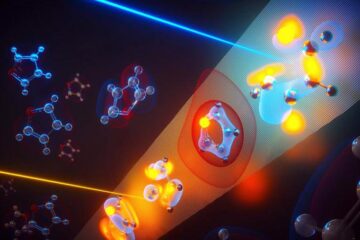

Attosecond core-level spectroscopy reveals real-time molecular dynamics

Chemical reactions are complex mechanisms. Many different dynamical processes are involved, affecting both the electrons and the nucleus of the present atoms. Very often the strongly coupled electron and nuclear…

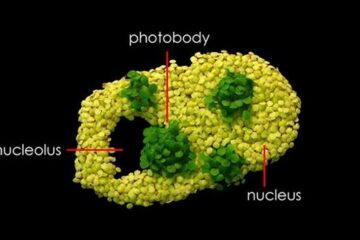

Free-forming organelles help plants adapt to climate change

Scientists uncover how plants “see” shades of light, temperature. Plants’ ability to sense light and temperature, and their ability to adapt to climate change, hinges on free-forming structures in their…