Taxation without documentation

Developing countries often lack the official government structure needed to collect taxes efficiently. This lack of systematic tax collection limits the ability of those countries to provide public services that aid growth, such as roads, sanitation and access to water.

But a new study co-authored by MIT economist Benjamin Olken reveals that developing countries actually have extensive informal systems in which citizens contribute money and labor to public-works projects. In effect, local governments in the developing world collect more taxes and produce more public goods than many outsiders have realized, a finding with implications for aid groups and governments trying to decide how to fund anti-poverty projects worldwide.

“It’s really surprising just how many people are doing this, and how prevalent this is,” says Olken, an associate professor in MIT’s Department of Economics. “This is a very common facet of how people experience life in a lot of developing countries. It’s supporting a large share of what’s going on at the village level.”

These informal taxes are generally regressive: While better-off citizens contribute more than the poor do in absolute terms, the percentage of income they pay is lower than the percentage of income that the poor pay. Because organizations such as World Bank sometimes recommend that governments use local co-financing of public-works projects, that means some programs intended to help curb poverty may actually place a larger relative tax burden on the poor.

“For aid groups, it’s useful to know what the distributional implications will be, and compare that to other financing mechanisms,” Olken says. “I hope that people will start thinking about these implications.”

Have asphalt, will organize

The research is presented in a new paper, “Informal Taxation,” by Olken and co-author Monica Singhal, an associate professor of public policy at the Harvard Kennedy School of Government. They examined 10 countries in the developing world and found that in many cases, more than 50 percent of citizens participate in these informal, local taxation schemes. In only one of the 10 nations did fewer than 20 percent of citizens pay additional informal taxes.

That changes our picture of taxation in the developing world. Previous studies have shown that formal, official taxation of households only accounts for 18 percent of taxes collected in the developing world, as opposed to 45 percent of taxes collected in the developed world. Given this fact, informal taxes provide a significant boost to local authorities: In Indonesia, for instance, informal taxes increase the amount of revenue under local control by more than 50 percent.

To conduct the study, Olken, Singhal and assistants from MIT’s Undergraduate Research Opportunities Program examined more than 100 existing field-research surveys, including the World Bank Living Standards Measurement Survey. Those surveys each have sample sizes ranging from about 1,500 to 30,000 people. The countries included in the paper are Albania, Ethiopia, Guatemala, Indonesia, Nigeria, Nicaragua, Panama, the Philippines, Vietnam and Zambia.

The paper is scheduled for publication in the American Economic Journal: Applied Economics later in 2011.

One impetus for the research came from Olken’s own experiences in Indonesia, where he has conducted field research for about a decade. In a village where he was once staying, Olken recalls, “the district government dropped off 29 drums of asphalt, and that was it. So the village had to decide what to do. They had a meeting, figured out how much they needed to pave a road in terms of money and labor, and basically went around the room and assigned contributions to people.”

Researchers have been aware that such practices existed; in Indonesia, these informal systems are called gotong royang, and in Kenya they are called harambee. But while the existing data Olken and Singhal used, such as the World Bank surveys, contain information about local life, that information had not previously been pieced together to create a picture of local taxation practices.

“We’re not the first people to have noticed this phenomenon, but I think this is the first paper to treat it like a tax issue,” Olken says.

“They mentioned the elephant in the room,” says Erzo Luttmer, an associate professor of economics at Dartmouth College. “Asking people to contribute labor to road projects, or to contribute money to replacing the roof on a school building, is a real tax, but it doesn’t show up in most statistics. Nobody had inquired as thoroughly into it until now.”

Give me your money or your labor

Among the quirks of informal taxation in the developing world, Olken notes, is that “it’s not formally enforced through the legal system.” And yet, the size of people’s contributions is not quite voluntary. About 84 percent of households in the survey data report that their levels of taxation are assigned by village or neighborhood leaders.

In many places, those payments can be made either by cash, or by contributing labor to the public-works projects. “The poorer people tend to contribute more in kind, and the richer people tend to do more in cash,” Olken says.

As Olken notes, that option — paying by labor or cash — constitutes what economists call an “optimal screening mechanism,” which adds to the knowledge local leaders have about their neighbors. “This kind of device, letting people do either in cash or in kind, can be a way of getting people … to reveal some information about themselves that you might otherwise not know.”

Luttmer hopes future research will help scholars further understand how citizens make these kinds of decisions. “Are people taxed when they have time to contribute labor?” he asks. “If it’s harvest time, do they have their children or wives attend to their own fields while they contribute labor to the common pool? Which systems lead to the most regressive forms of taxation, and which lead to more progressive tax burdens?”

Media Contact

More Information:

http://www.mit.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Attosecond core-level spectroscopy reveals real-time molecular dynamics

Chemical reactions are complex mechanisms. Many different dynamical processes are involved, affecting both the electrons and the nucleus of the present atoms. Very often the strongly coupled electron and nuclear…

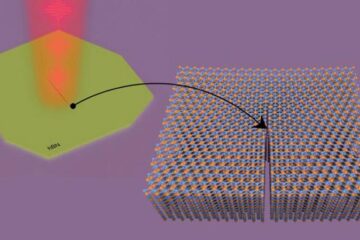

Columbia researchers “unzip” 2D materials with lasers

The new technique can modify the nanostructure of bulk and 2D crystals without a cleanroom or expensive etching equipment. In a new paper published on May 1 in the journal…

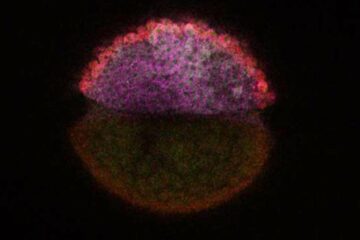

Decoding development: mRNA’s role in embryo formation

A new study at Hebrew University reveals insights into mRNA regulation during embryonic development. The study combines single-cell RNA-Seq and metabolic labeling in zebrafish embryos, distinguishing between newly-transcribed and pre-existing…