Study separates russian flat tax myth and fact

The new tax policy slashed taxes for higher-income Russians who previously paid rates of 20 and 30 percent. Despite the savings to taxpayers, real tax revenues reaped by the government increased by 25 percent in the year after the reform. The windfall, flat tax advocates say, happened because a simpler, fairer tax system leads to better compliance, and because lower taxes spur productivity.

That assessment is half right, according to a study published this month in the Journal or Political Economy. The study by economists Yuriy Gorodnichenko (University of California, Berkeley), Jorge Martinez-Vazquez and Klara Sabirianova Peter (both of Georgia State University) looked at household level data to see how tax reform influenced tax evasion and real income. The study found that tax evasion decreased under the flat tax, but the reform did little to increase real income for taxpayers.

The lesson? Where underreporting of income is widespread, a flat tax can produce a revenue increase, but don't expect massive economic productivity gains.

Tax evasion by nature is tough to quantify. To get an estimate of the extent to which Russians hide income from the tax collector, the researchers used what they call the “consumption-income gap.” They gathered data from household surveys conducted in 1998 and from 2000 to 2004 by the University of North Carolina. The surveys asked respondents to catalog their monthly spending on everything from food to entertainment. The data from these surveys show that Russians generally spend 30 percent more than they report receiving in income. It's unlikely that households are getting the extra buying power by dipping into savings accounts, because most of those surveyed had little or no savings. So the gap between household consumption and reported income is largely explained by an underreporting of income.

Looking at the survey data over time, the researchers found that the consumption-income gap shrank substantially in the years after the tax reform. In other words, the amount of income Russians reported got closer to the amount they spent. This effect was strongest for households who had been in the highest tax brackets before the reform. That's a good indication that the flat tax was directly responsible for decreasing tax evasion in Russia.

The other implication in these data is that the flat tax seems to have done little to increase real income for taxpayers. If real income had increased substantially, one would expect consumption to increase as well. That wasn't the case. Taxpayers whose tax rates were cut increased their consumption net of windfall gains by less than 4 percent.

“The results of this paper have several important policy implications,” the authors write.

“The adoption of a flat rate income tax is not expected to lead to significant increases in tax revenues because the productivity response is shown to be fairly small. However, if the economy is plagued by ubiquitous tax evasion, as was the case in Russia, the flat rate income tax reform can lead to substantial revenue gains via increases in voluntary compliance.”

Yuriy Gorodnichenko, Jorge Martinez-Vazquez, Klara Sabirianova Peter, “Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia.” Journal of Political Economy, June 2009.

Media Contact

More Information:

http://www.uchicago.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

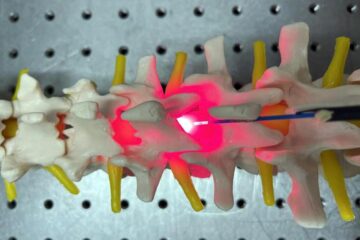

Red light therapy for repairing spinal cord injury passes milestone

Patients with spinal cord injury (SCI) could benefit from a future treatment to repair nerve connections using red and near-infrared light. The method, invented by scientists at the University of…

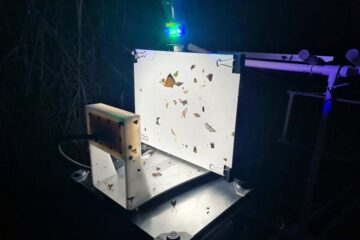

Insect research is revolutionized by technology

New technologies can revolutionise insect research and environmental monitoring. By using DNA, images, sounds and flight patterns analysed by AI, it’s possible to gain new insights into the world of…

X-ray satellite XMM-newton sees ‘space clover’ in a new light

Astronomers have discovered enormous circular radio features of unknown origin around some galaxies. Now, new observations of one dubbed the Cloverleaf suggest it was created by clashing groups of galaxies….