Study proposes new measure of world equity market segmentation

The study, by Columbia Business School Professor Geert Bekaert, Chazen Senior Scholar at The Jerome A. Chazen Institute of International Business at Columbia Business School and the Leon G. Cooperman Professor of Finance and Economics, uncovers the factors that cause variation in market segmentation, both through time and across countries.

Although barriers to capital flows often lead to equity market segmentation, a country's political risk profile and its stock market development are two particularly important local factors behind a lack of integration, Bekaert and his coauthors found. In addition, the U.S. corporate credit spread is an important factor on a global level. The study is coauthored by Campbell R. Harvey, J. Paul Sticht Professor in International Business, Fuqua School of Business, Duke University; Christian T. Lundblad, Edward M. O'Herron Distinguished Scholar and Associate Professor of Finance, Kenan-Flagler Business School, University of North Carolina; and Stephan Siegel, University of Washington Business School.

The removal of capital controls in developed countries in the 1980s and in emerging markets in the 1980s and early 1990s has led to a new era of global financial openness and trade. These changes should have had a profound effect on the valuations of stocks across the world, and therefore impact critical economic issues such as the cost of capital. However, although many countries have experienced decreased segmentation, significant levels of segmentation remain in emerging markets, the authors found.

In the study, the authors describe their new way of measuring the degree of effective or de facto equity market segmentation. Unlike most existing measures, the authors' framework is not tied to a specific asset pricing model. Instead, this country-level measure is based on industry earnings yield differentials, aggregated across all industries in a given country. With this new measure, it is easier to understand why one country is more segmented than another, and why this degree of segmentation changes over time.

Using this new measure, the authors test the degree that local and global factors account for valuation, after controlling for a country's global growth opportunities in its mix of industries. A main driver of segmentation is de jure access: some markets are simply closed by law to foreign investment. Yet even when a country is formally open, foreign investors may shun markets with weak corporate governance. The authors found that while equity market openness is the single most important economic variable in segmentation, stock market development is almost as important. Exploring segmentation at the industry level, the authors found that historically heavily regulated industries such as banking and insurance were among the least integrated early in their sample timeframe, but are now among the most integrated.

The authors used data from the United States, an effectively integrated economy, as a benchmark, and applied their new measure to 69 countries using monthly equity industry portfolio data from Datastream and firm-level data from the Standard & Poor's Emerging Markets Database across a time period of more than 20 years. The study documents the extent to which market segmentation has decreased over time, and shows that while developed countries have been effectively integrated since 1993, emerging markets continue to demonstrate levels of segmentation above the U.S. benchmark. As discount rates and growth opportunities become global in nature, this new measure of the absolute difference between local and global valuation ratios will shrink, the authors conclude.

About Columbia Business School

Led by Dean Glenn Hubbard, the Russell L. Carson Professor of Finance and Economics, Columbia Business School is at the forefront of management education for a rapidly changing world. The school's cutting-edge curriculum bridges academic theory and practice, equipping students with an entrepreneurial mindset to recognize and capture opportunity in a competitive business environment. Beyond academic rigor and teaching excellence, the school offers programs that are designed to give students practical experience making decisions in real0world environments. The school offers MBA and Executive MBA (EMBA) degrees, as well as non-degree Executive Education programs. For more information, visit www.gsb.columbia.edu.

Media Contact

More Information:

http://www.columbia.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Microscopic basis of a new form of quantum magnetism

Not all magnets are the same. When we think of magnetism, we often think of magnets that stick to a refrigerator’s door. For these types of magnets, the electronic interactions…

An epigenome editing toolkit to dissect the mechanisms of gene regulation

A study from the Hackett group at EMBL Rome led to the development of a powerful epigenetic editing technology, which unlocks the ability to precisely program chromatin modifications. Understanding how…

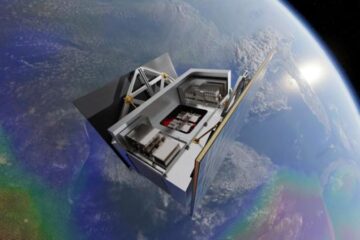

NASA selects UF mission to better track the Earth’s water and ice

NASA has selected a team of University of Florida aerospace engineers to pursue a groundbreaking $12 million mission aimed at improving the way we track changes in Earth’s structures, such…