Companies restricting shareholder rights selected Arthur Anderson firm

Pornsit Jiraporn, assistant professor of finance at Penn State Great Valley graduate school, in suburban Philadelphia, said it's hard to say exactly why this was the case. Could it be that Arthur Anderson was inferior to the other “Big Six” accounting firms—as some prior research has concluded—and thus less likely to catch auditing errors or “fudged” financial statements, was there perhaps something more complicit at work, or neither?

“For some reason, Arthur Anderson attracted companies with weak shareholder rights,” he said. “There's been a question in the accounting world of whether the Houston office and the Enron fiasco brought the company down, or whether there were company-wide problems that spread throughout the organization. Based on this study, I think the whole system at Arthur Anderson was faulty.”

Jiraporn published his findings in the article “Shareholder Rights, Corporate Governance, and Arthur Anderson,” in the fall/winter issue of Journal of Applied Finance,

In the study, the Penn State researcher employed the Governance Index, which measures the restrictions placed on shareholder rights, to rate more than 1,000 companies. It is widely accepted that companies that score high on the GI place greater power in the hands of management, often to the detriment of shareholder return.

When shareholders have greater rights, this signals a stronger link between ownership and control, and typically leads to better return on their investment. The corporate clients of Arthur Anderson tended to score higher on this index than those of the other “Big Six” accounting firms.

This correlation between weak shareholder rights and employing Arthur Anderson was not present in regulated firms, according to the study.

“I argue that this is because regulatory monitoring substitutes for external auditing and, hence, influences the association between shareholder rights and auditor choice,” said Jiraporn.

Media Contact

More Information:

http://www.psu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Attosecond core-level spectroscopy reveals real-time molecular dynamics

Chemical reactions are complex mechanisms. Many different dynamical processes are involved, affecting both the electrons and the nucleus of the present atoms. Very often the strongly coupled electron and nuclear…

Columbia researchers “unzip” 2D materials with lasers

The new technique can modify the nanostructure of bulk and 2D crystals without a cleanroom or expensive etching equipment. In a new paper published on May 1 in the journal…

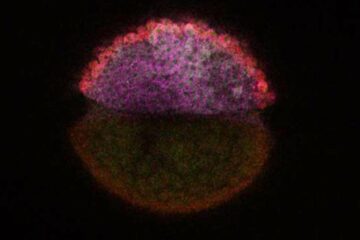

Decoding development: mRNA’s role in embryo formation

A new study at Hebrew University reveals insights into mRNA regulation during embryonic development. The study combines single-cell RNA-Seq and metabolic labeling in zebrafish embryos, distinguishing between newly-transcribed and pre-existing…