Clearstream announces innovative post trade solution for Investment Funds in Luxembourg

Clearstream, the international central securities depository within the Deutsche Börse Group, announces the launch of the Central Facility for Funds (CFF). CFF is an innovative initiative to offer a more efficient post trade solution for investment funds domiciled in Luxembourg, the largest market in Europe for international funds. The launch of the new service is planned for the second half of 2007 and a pilot will begin end of 2006.

CFF will provide DVP (delivery versus payment) facilities between fund distributors and transfer agents. Its single set of settlement and payment instructions for all eligible funds will simplify operational processes and reduce risks.

CFF will provide post trade services only, with an architecture open to the various order execution processes. The service is initially offered for investment funds domiciled in Luxembourg, but its business model and operating model could be applied to other funds domiciles.

CFF will be open to transfer agents for Luxembourg domiciled funds as well as domestic and international distributors or large institutional investors. It will not change the direct relationship between distributors and transfer agents and it will not provide direct access for retail customers or independent financial advisors (IFA).

The CFF initiative is an answer to growing market demand in Europe and in Luxembourg, Europe’s biggest market for international investment funds with over € 1.5 trillion in outstanding value in 2005. Although the industry is developing fast (80% growth over three years), its post trade area is characterized by high fragmentation, little standardisation and thus operational risk. Several significant market participants –distributors, promoters, transfer agents and trade associations (ISSA, EFAMA)- in Europe and in Luxembourg have been consulted by Clearstream and have contributed to the design of the CFF concept.

Jeffrey Tessler, CEO of Clearstream stated, “CFF is the result of an extensive consultation with Luxembourg’s market participants looking for a reduction in risks and costs. We are particularly pleased to have been asked to put Clearstream’s expertise in other asset classes such as bonds or equities, at the service of the investment funds industry. We look forward to continue working with market participants in developing the solution best adapted to their needs and best suited for the industry’s benefits”.

Clearstream, the international central securities depository within the Deutsche Börse Group, announces the launch of the Central Facility for Funds (CFF). CFF is an innovative initiative to offer a more efficient post trade solution for investment funds domiciled in Luxembourg, the largest market in Europe for international funds. The launch of the new service is planned for the second half of 2007 and a pilot will begin end of 2006.

CFF will provide DVP (delivery versus payment) facilities between fund distributors and transfer agents. Its single set of settlement and payment instructions for all eligible funds will simplify operational processes and reduce risks.

CFF will provide post trade services only, with an architecture open to the various order execution processes. The service is initially offered for investment funds domiciled in Luxembourg, but its business model and operating model could be applied to other funds domiciles.

CFF will be open to transfer agents for Luxembourg domiciled funds as well as domestic and international distributors or large institutional investors. It will not change the direct relationship between distributors and transfer agents and it will not provide direct access for retail customers or independent financial advisors (IFA).

The CFF initiative is an answer to growing market demand in Europe and in Luxembourg, Europe’s biggest market for international investment funds with over € 1.5 trillion in outstanding value in 2005. Although the industry is developing fast (80% growth over three years), its post trade area is characterized by high fragmentation, little standardisation and thus operational risk. Several significant market participants –distributors, promoters, transfer agents and trade associations (ISSA, EFAMA)- in Europe and in Luxembourg have been consulted by Clearstream and have contributed to the design of the CFF concept.

Jeffrey Tessler, CEO of Clearstream stated, “CFF is the result of an extensive consultation with Luxembourg’s market participants looking for a reduction in risks and costs. We are particularly pleased to have been asked to put Clearstream’s expertise in other asset classes such as bonds or equities, at the service of the investment funds industry. We look forward to continue working with market participants in developing the solution best adapted to their needs and best suited for the industry’s benefits”.

Clearstream, the international central securities depository within the Deutsche Börse Group, announces the launch of the Central Facility for Funds (CFF). CFF is an innovative initiative to offer a more efficient post trade solution for investment funds domiciled in Luxembourg, the largest market in Europe for international funds. The launch of the new service is planned for the second half of 2007 and a pilot will begin end of 2006.

CFF will provide DVP (delivery versus payment) facilities between fund distributors and transfer agents. Its single set of settlement and payment instructions for all eligible funds will simplify operational processes and reduce risks.

CFF will provide post trade services only, with an architecture open to the various order execution processes. The service is initially offered for investment funds domiciled in Luxembourg, but its business model and operating model could be applied to other funds domiciles.

CFF will be open to transfer agents for Luxembourg domiciled funds as well as domestic and international distributors or large institutional investors. It will not change the direct relationship between distributors and transfer agents and it will not provide direct access for retail customers or independent financial advisors (IFA).

The CFF initiative is an answer to growing market demand in Europe and in Luxembourg, Europe’s biggest market for international investment funds with over € 1.5 trillion in outstanding value in 2005. Although the industry is developing fast (80% growth over three years), its post trade area is characterized by high fragmentation, little standardisation and thus operational risk. Several significant market participants –distributors, promoters, transfer agents and trade associations (ISSA, EFAMA)- in Europe and in Luxembourg have been consulted by Clearstream and have contributed to the design of the CFF concept.

Jeffrey Tessler, CEO of Clearstream stated, “CFF is the result of an extensive consultation with Luxembourg’s market participants looking for a reduction in risks and costs. We are particularly pleased to have been asked to put Clearstream’s expertise in other asset classes such as bonds or equities, at the service of the investment funds industry. We look forward to continue working with market participants in developing the solution best adapted to their needs and best suited for the industry’s benefits”.

Media Contact

More Information:

http://www.deutsche-boerse.comAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Microscopic basis of a new form of quantum magnetism

Not all magnets are the same. When we think of magnetism, we often think of magnets that stick to a refrigerator’s door. For these types of magnets, the electronic interactions…

An epigenome editing toolkit to dissect the mechanisms of gene regulation

A study from the Hackett group at EMBL Rome led to the development of a powerful epigenetic editing technology, which unlocks the ability to precisely program chromatin modifications. Understanding how…

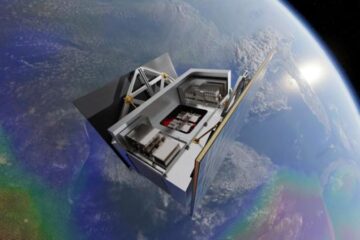

NASA selects UF mission to better track the Earth’s water and ice

NASA has selected a team of University of Florida aerospace engineers to pursue a groundbreaking $12 million mission aimed at improving the way we track changes in Earth’s structures, such…