Do market prices reflect customers’ social networks?

Pekka Sääskilahti, MSc (Econ.), will defend his doctoral thesis entitled ”Essays on the Economics of Networks and Social Relations” at the Helsinki School of Economics on December 7, 2005. The public defence will start at 12 o’clock in the Stora Enso Hall of the Chydenia building (address: Runeberginkatu 22-24, Helsinki). The opponent is Professor Robin Mason, PhD, (University of Southampton) and the custos is Professor Pekka Ilmakunnas, PhD, (Helsinki School of Economics).

Modern society is built on networks. Transportation networks take people from one place to another; information networks do the same virtually. Family, friends, colleagues and neighbours form our social relations. Livelihood may depend less on family today than in ancient agrarian times, but leisure time is at least as social as it ever was. Mr. Sääskilahti asks how companies take their customers’ social networks into account in their pricing and investment strategies.

The utility of social goods increases the more people adopt them. This feature is called network externality. The fax machine is a classic example. One fax is useless, but once there are millions of faxes, the utility of a single machine is significant. Modern examples include mobile phones, game consoles, software, and many Internet-based services. As far as network externalities are concerned, the consumer’s buying decision follows the “I buy only if you buy” strategy. Since all consumers think this way, we have multiple equilibria: all buy or no one buys. This indeterminacy regarding equilibrium is a problem because we obtain multiple predictions about the firm’s strategy even under a single market environment.

In the first part of the dissertation, Mr. Sääskilahti shows how the multiplicity of equilibria is not as acute a problem as network economics has conventionally predicted, and that consumers are able to make determinate decisions even under network externalities. Then Mr. Sääskilahti shows that a firm is always worse off when uncertainty among consumers about the utility of a commodity increases . On the other hand, greater uncertainty increases the utility of the consumers if the level of uncertainty is already sufficiently high.

Network externalities are given a functional form in the conventional network model. This approach involves an implicit assumption on the network structure: each member has a relation with everyone else in the network. However, in reality most networks are less connected, and many networks are asymmetric so that some members are better linked than others.

In the second part of the dissertation, Mr. Sääskilahti studies how network structure affects the firm’s pricing strategy. He shows that network topology is a more important factor than network size. The central network agents benefit from their positions at the expense of more peripheral members, because the firm sets the price favouring the central agents. Increasing the size of the network benefits the firm and the central agents, but the peripheral agents are adversely affected. Asymmetry of the network, however, constrains the firm’s profits. The results question the popular Internet-strategy of the 1990s, which considered it imperative to increase the network size as fast as possible. It would have been more important to identify the central agents.

Interaction in many social networks is facilitated by technological innovations. In the third part of the dissertation, Mr. Sääskilahti studies the interface between social networks and technological development. Private research and development (R&D) often leaks to rivals. Mr. Sääskilahti asks how the joint effect of technological leakages and network externalities affects the firms’ pricing and R&D-investment strategies. Counter-intuitively, a decrease in the level of private R&D appropriability leads to an increase in R&D efforts by a firm if the network externalities are strong. However, the industry-wide R&D level decreases as rival companies reduce their own investments.

Media Contact

More Information:

http://helecon3.hkkk.fi/diss/All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

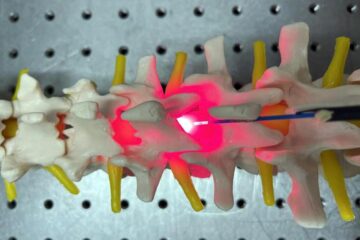

Red light therapy for repairing spinal cord injury passes milestone

Patients with spinal cord injury (SCI) could benefit from a future treatment to repair nerve connections using red and near-infrared light. The method, invented by scientists at the University of…

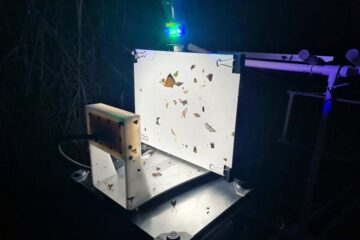

Insect research is revolutionized by technology

New technologies can revolutionise insect research and environmental monitoring. By using DNA, images, sounds and flight patterns analysed by AI, it’s possible to gain new insights into the world of…

X-ray satellite XMM-newton sees ‘space clover’ in a new light

Astronomers have discovered enormous circular radio features of unknown origin around some galaxies. Now, new observations of one dubbed the Cloverleaf suggest it was created by clashing groups of galaxies….