Inflation and Dollar Depreciation

Recently, two major economic changes have taken place. First, the value of the dollar has fallen appreciably. From early March to June 1, the dollar index fell nearly 11 percent.

Second, interest rates on longer-term Treasury securities (those with maturities ranging from 10 to 30 years) have increased dramatically. This took place even though the Federal Reserve Bank purchased nearly $600 billion of Treasuries and mortgage-backed securities. Interest rates on 30-year fixed rate mortgages are tied to 10-year Treasury Note rates. Late in May, rates on both increased. The increase in mortgage interest rates has long-term negative implications for an already-depressed housing market.

Furthermore, increases in longer-term Treasury rates result in increases in corporate bond interest rates. Such increases dampen corporate plans to make capital expenditures, thereby prolonging the recession.

Both the dollar depreciation and the increase in longer-term interest rates are attributable to fears of significant long-term inflation resulting from massive government borrowing and anticipated ongoing deficit spending. Expecting inflation, investors worldwide tend to move their money from dollars to what they believe will be more stable currencies. This results in depreciation of the dollar.

The decreasing value of the dollar has resulted in China calling for another currency to replace the dollar as the major reserve currency. (A reserve currency is a stable currency that is used for a significant portion of international trade.) Although this is unlikely to take place, countries could well decide to replace the dollar with a basket of currencies. Such a move would reduce the demand for the dollar, resulting in its further depreciation.

The actual increases in longer-term interest rates result primarily from the fact that bond purchasers – who take a long-term view of the economy – want to obtain a real (inflation-adjusted) return on their investments. Consequently, whenever they expect inflation to increase, they require higher interest rates to compensate them for the anticipated losses in purchasing power that will result from the impending inflation. This fear of inflation drives longer-term interest rates upward.

Similarly, anticipated inflation has a negative impact on stock prices. When stock market investors foresee inflation, they too want higher total returns. This results in dampening of stock prices. This dampening is harmful for two primary reasons.

First, people spend less when they have less wealth. Lower stock prices (as well as low real estate prices) result in decreased consumer spending and prolong the recession. Higher stock prices stimulate spending and economic growth.

Second, at present, many retirees and would-be retirees have seen 40-percent decreases in their 401(k) plans. Many retirees have been forced to return to work; many would-be’s have been forced to postpone retirement. This has led to personal hardship for many, contributed to the increased unemployment, will lead to higher long-term unemployment and will postpone economic recovery. Baby Boomers, especially, are frightened about their futures; many are reluctant to spend.

The depreciating value of the dollar is already having significant negative effects on the economy. For example, worldwide contracts for many commodities and all contracts for oil are denominated in dollars. Thus, when the value of the dollar depreciates relative to other currencies, the price of oil increases. Mid-summer 2008, crude oil futures spiked at about $150 per barrel. When the worldwide financial meltdown threw most of the world into recession, oil dropped to a low of about $33 a barrel (end of 2008 – February 2009). Since then, oil has increased to about $67 a barrel.

Similarly, gasoline prices have already hit $2.51 a gallon following a December 2008 low of $1.61 (as reported by AAA). For a person purchasing 15 gallons per week, this increase equates to a “gas tax” of $700 a year. From a macroeconomic viewpoint, the U.S. consumes about 378 million gallons of gasoline a day. On an annualized basis, the recent $.90 per gallon price increase translates into an additional $124 billion per year. Higher gasoline prices act like regressive taxes, decreasing discretionary expenditures and prolonging the recession.

Continued high levels of government deficit spending will impede economic recovery as well as result in prolonged high rates of unemployment and inflation. In 1980, the last year of the Carter presidency, inflation was 13.58 percent and unemployment 7.18 percent: the “misery index” totaled 20.76 percent. Currently, unemployment is 8.9 percent (and expected to increase to 10+ percent); inflation is negligible. Once inflation rears its ugly head, we could experience a rapid return to a 20 percent misery index. Fiscal policy must be addressed now to avoid this scenario.

NOTE: Pritchard is the senior member of the Rohrer College of Business faculty. Pritchard has authored/co-authored nine books in the fields of finance, small business management and marketing and has written more than 250 trade journal articles. He has consulted and provided financial training for many businesses and trade associations throughout the United States. Pritchard's research interests include real estate, personal financial management, retirement planning and Social Security. He may be contacted by e-mail: Pritchard@rowan.edu.

Media Contact

More Information:

http://www.rowan.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

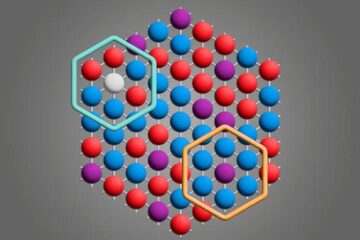

Microscopic basis of a new form of quantum magnetism

Not all magnets are the same. When we think of magnetism, we often think of magnets that stick to a refrigerator’s door. For these types of magnets, the electronic interactions…

An epigenome editing toolkit to dissect the mechanisms of gene regulation

A study from the Hackett group at EMBL Rome led to the development of a powerful epigenetic editing technology, which unlocks the ability to precisely program chromatin modifications. Understanding how…

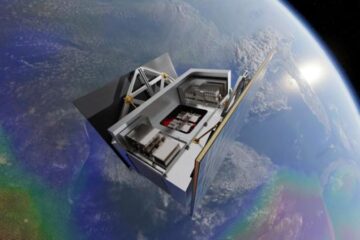

NASA selects UF mission to better track the Earth’s water and ice

NASA has selected a team of University of Florida aerospace engineers to pursue a groundbreaking $12 million mission aimed at improving the way we track changes in Earth’s structures, such…