Effective global regulation – a gargantuan task

This was a policy response to an unprecedented global financial crisis, aimed at preventing financial meltdown. It succeeded in doing so, according to Professor Panicos Demetriades, an Economist funded by the Economic and Social Research Council (ESRC) at the Department of Economics of the University of Leicester.

The main lesson of Professor Demetriades’ research for the current crisis is that government owned banks should not be privatised before depositors can be confident that an effective system of financial regulation is in place. This is much easier said than done in the context of markets in which the lack of transparency, the complexity of products and international linkages make the design of an effective global regulatory structure a gargantuan task.

Professor Demetriades said, “The signs of large scale bank runs and the collapse of banking systems were clearly visible in the horizon, especially after the collapse of Lehman Brothers. If Lehman Brothers could collapse, others were likely to follow, which explains the panic selling of bank shares that we observed. In situations like these – given information imperfections – even the most prudent banks are affected, hence the danger of financial meltdown was a very real one. As depositors too began to lose faith in private banks, funds fled to the only safe haven – government bonds and government owned banks.”

The presence of deposit insurance did little to reassure depositors. This was in part because deposit insurance is rarely a blanket guarantee of all deposits (e.g. local authorities and businesses are not normally covered). Even if it was one, the prospect of filing for compensation of lost deposits is a much inferior alternative to having one’s money safe in a government owned bank.

Until recently, government ownership of banks was frowned upon as a feature of developing countries. Moreover, it was widely seen as politically motivated. Some economists argued that government ownership of banks is widespread because of the benefits it confers on politicians – hence this is known as the ‘political view of state banks’. They also argued, drawing on cross-country correlations, that it is associated with financial instability and low growth. They therefore concluded that bank privatisation would result in faster economic growth and fewer banking crises. Earlier this year, Leicester University academics Svetlana Andrianova and Panicos Demetriades and Brunel’s Anja Shortland published an article in the Journal of Development Economics which challenges these views. Even though their paper was written with developing countries in mind, most of its conclusions are applicable to the current crisis.

“Recent events”, explains Demetriades “make it easy to see why previous experience on the ‘political view’ of state banks is flawed. The positive correlation that arises in a cross-country relationship between government ownership of banks and financial crises frequently reflects reverse causality i.e. private banks that fail end up under government ownership because no other investor would buy them. Moreover, the financial crisis that preceded the government takeovers of banks is normally followed by severe recessions. To ascribe the blame to governments is like arguing that hospitals are the causes of ill health because they are associated with illness.”

In terms of real world examples, Russia provides a good example in which the state savings bank – Sberbank – is able to attract the largest proportion of deposits while offering deposit rates that are lower than its private sector competitors. Northern Rock – nationalised by the UK government in 2007 – is now another case in point: despite offering low interest rates it was massively oversubscribed and had to turn depositors away.

The paper by Andrianova, Demetriades and Shortland utilises a theoretical model which demonstrates that government owned banks are a safe haven for depositors when regulatory institutions that govern the behaviour of banks are perceived by depositors as weak. At the extreme, the presence of unchecked opportunistic behaviour by private banks results in a complete preference for the government owned bank by all depositors. Privatising the government bank under these circumstances can only result in financial dis-intermediation i.e. depositors withdrawing their funds from the banking system altogether.

Empirical analyis, within the paper utilises data on 108 countries from the World Bank survey on banking practices and regulation, and the World Bank database of governance indicators. The estimations show that regulatory quality and disclosure are inversely related to government ownership of banks. The empirical findings also suggest that increased government ownership is positively associated with prior banking crises frequently involving (private) bank failures.

The paper warns, however, against interpreting this in a naive way: just like in the current crisis, the correlation between government ownership of banks and financial instability often reflects reverse causation i.e. governments tend to take over failed private banks. Hence, the paper concludes that privatisation of government owned banks is not be the best way forward in terms of developing banking systems, where institutions are weak. Institutions building should be the top priority.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

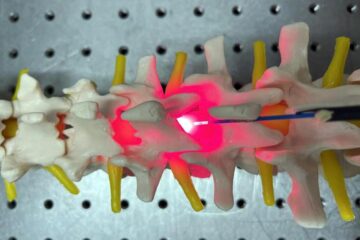

Red light therapy for repairing spinal cord injury passes milestone

Patients with spinal cord injury (SCI) could benefit from a future treatment to repair nerve connections using red and near-infrared light. The method, invented by scientists at the University of…

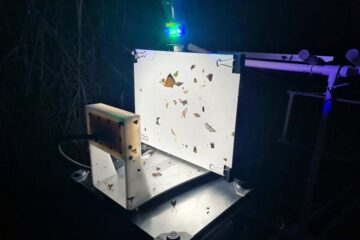

Insect research is revolutionized by technology

New technologies can revolutionise insect research and environmental monitoring. By using DNA, images, sounds and flight patterns analysed by AI, it’s possible to gain new insights into the world of…

X-ray satellite XMM-newton sees ‘space clover’ in a new light

Astronomers have discovered enormous circular radio features of unknown origin around some galaxies. Now, new observations of one dubbed the Cloverleaf suggest it was created by clashing groups of galaxies….