Cash hoarding nothing new for businesses, scholar says

Finance professor Heitor Almeida says the fact that businesses are stuffing corporate piggy banks with spare cash for the proverbial “rainy day” is unrelated to the belt-tightening brought about by the continuing financial crisis.

“There's not really a consensus on what accounts for businesses holding so much cash, but they've been doing it way before the downturn, at least since the early 1980s,” he said. “Cash hoarding is definitely not related to the financial crisis. It's a pattern that's been going on for at least three decades.”

Although there was a time shortly after the crisis when firms had difficulty raising capital, Almeida says most businesses entered it in a “very liquid position.”

“When the crisis hit, firms had a lot of cash on hand, and they used it to avoid decreasing investment and firing employees,” he said. “If businesses hadn't had all that cash on hand, things could have been much, much worse.”

Almeida says companies that survived the financial shocks of the past few years are still jittery about weak consumer demand in the U.S. and an increasingly dismal forecast for the global recovery, so they'll likely continue to sit on their piles of cash.

“You would think if they had better uses for that cash they would have spent it, but for some reason corporations have decided that the best thing they can do is keep the cash on the balance sheet,” he said.

Part of this is due to most big firms being multinational, allowing them to park the bulk of their cash outside of the U.S. in tax havens.

“If you keep profits outside of the U.S., obviously, they won't get taxed,” he said. “The way U.S. tax laws are written is that firms pay taxes the moment they repatriate the cash, which would be quite costly to shareholders.”

Almeida says there were proposals to give firms a tax break if they brought their money back to the U.S., but reviving such a proposal now “wouldn't be a politically viable option, especially not after all the bank bailouts.”

If repatriating the cash is off the table, shouldn't shareholders demand some of that cash be re-paid as dividends?

“Firms are not obligated to pay dividends, and it's pretty much the case that the most successful firms are going to be the ones that hoard the most cash,” Almeida said. “A really successful company like Google or Apple, for example, isn't going to go to the market and issue $30 billion in equity only to turn around and sit on the cash. With extremely successful companies, cash just accumulates. Shareholders may get mad, but cash-holding is positively correlated with shareholder returns, so it's no surprise.”

Almeida said even if companies did open up the coffers and flood the economy with cash, what might be good for job creation in the short-term might not necessarily be consonant with what shareholders want.

“If you invest money to create jobs but generate negative profits, that's not good for shareholders,” he said. “So that's probably not what firms should be doing, as much as we want to grow jobs.”

Stimulating lending by further lowering interest rates is not likely to have much of an effect on job creation, either.

“The fact that firms have cash suggests that getting banks to lend more isn't the way to go,” Almeida said. “Firms already have cash but they're not spending it. So what's the point of having banks make more loans, if firms don't need the cash?”

President Obama's call for tax breaks for corporate investment, which would allow businesses to write off the cost of new investments in plants and equipment, and thereby create an incentive for businesses to spend money, are a step in the right direction, Almeida says.

“The government made the right call here,” he said. “There's no point in spurring bank lending if firms have cash to spare, so creating an incentive for them to spend through a tax break for investment is a good idea.”

But the key thing that government should focus on in the near term, Almeida says, is fixing the broken housing market, which is still mired in a post-bubble slump.

“The key thing is fixing the housing market, but there are some big structural problems associated with it,” he said.

One is that a lot of households still carry too much mortgage-related debt.

“What the government has been trying to do, albeit unsuccessfully, is negotiate homeowner's debt down to a level they can actually handle,” Almeida said. “Banks will inevitably take a hit from this, but homeowners would get to keep their house. That's difficult to do with securitized loans – the entity that holds the loan is not the loan originator. So the government is struggling to solve this problem, which is the fundamental weakness behind the slow economy.”

According to Almeida, the prime enabler for helping to create the housing bubble is the continued governmental support for Fannie Mae and Freddie Mac, the secondary mortgage markets they sponsor to ostensibly make mortgage loans more affordable.

“That's what got us into real trouble,” he said. “The U.S. needs to get out of the mortgage lending business, even if the repercussions of that means making housing less affordable in the short-term. That may sound like the wrong thing to do, to make things harder for people, but it's what the U.S. needs to do to strengthen the housing market.”

According to Almeida, another more long-term structural problem the U.S. needs to tackle is education.

“Firms use recessions to get rid of employees and replace them with technology,” he said. “The U.S. needs to create a more capable workforce that's ready for the new economy by investing a lot more heavily in education. The U.S. has great universities, but primary and secondary education needs to catch up, otherwise those universities will be increasingly composed of foreign students.”

The only problem with structural change in an area like education is it takes decades, Almeida said.

“But you've got to start somewhere. The Obama administration is very aware of this.”

Editor's note: To contact Heitor Almeida, call 217-333-2704; e-mail halmeida@illinois.edu

Media Contact

More Information:

http://www.illinois.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Microscopic basis of a new form of quantum magnetism

Not all magnets are the same. When we think of magnetism, we often think of magnets that stick to a refrigerator’s door. For these types of magnets, the electronic interactions…

An epigenome editing toolkit to dissect the mechanisms of gene regulation

A study from the Hackett group at EMBL Rome led to the development of a powerful epigenetic editing technology, which unlocks the ability to precisely program chromatin modifications. Understanding how…

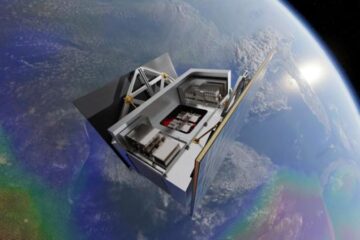

NASA selects UF mission to better track the Earth’s water and ice

NASA has selected a team of University of Florida aerospace engineers to pursue a groundbreaking $12 million mission aimed at improving the way we track changes in Earth’s structures, such…