Over US$5 trillion of Sustainable Investing funds available to relaunch the global economy

In their new book Sustainable Investing, Cary Krosinsky and Nick Robins highlight that Sustainable Investing funds already amount to more than US$5trillion, and calculate that up to a quarter of public equities, as well as corporate and government bonds, (estimated to be worth US$120 trillion in 2006) incorporate parts of the sustainability agenda. This money, focused on the long-term opportunities arising from environmental and social imperatives, could help finance a resurgent and more resilient global economy.

Importantly, Sustainable Investing is not only attracting assets, but also delivering compelling returns. New research by Cary Krosinsky shows that Sustainable Investment funds significantly outperformed mainstream indices between December 2002 and December 2007, returning +18.7%, on average, versus the MSCI World, S&P 500 and FTSE 100’s returns of +17.0%, +13.2% and +13.0%, respectively.

For example, between 2002 and 2007 the Winslow Green Growth Fund significantly outperformed Warren Buffett’s holding company Berkshire Hathaway, registering 200% growth compared to Buffet’s 100%. Looking forward, Jackson Robinson, Portfolio Manager for The Winslow Green Growth Fund states “We believe that the green economy offers one of the most promising paths to economic recovery, and therefore continues to appear very attractive to us as a long-term investment opportunity.”

This trend looks set to continue, as Sustainable Investing funds generate superior risk-adjusted returns by incorporating long-term environmental, social and economic trends within investment and ownership decision-making, rather than following the short-term strategies that has driven the global economy to its knees.

According to Nick Robins, “whether they are huge pension funds or individual savers, investors are looking for strategies that offer long-term security– and sustainable investing provides the answer. As the world seeks to stimulate an economic recovery, sustainable investing in clean technologies, microfinance and social enterprise offer proven routes to generating wealth and resolving pressing problems such as climate change and global poverty.”

Cary Krosinsky is vice president for Trucost Plc. Nick Robins is head of the HSBC Climate Change Centre of Excellence. Their book Sustainable Investing: The Art of Long-Term Performance is published by Earthscan.

Media Contact

More Information:

http://www.earthscan.co.uk/?tabid=4833All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

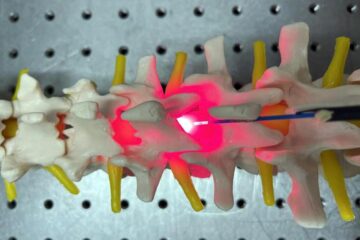

Red light therapy for repairing spinal cord injury passes milestone

Patients with spinal cord injury (SCI) could benefit from a future treatment to repair nerve connections using red and near-infrared light. The method, invented by scientists at the University of…

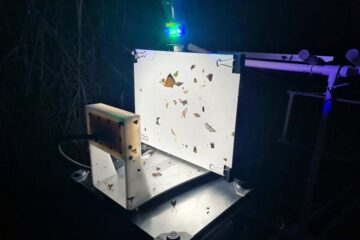

Insect research is revolutionized by technology

New technologies can revolutionise insect research and environmental monitoring. By using DNA, images, sounds and flight patterns analysed by AI, it’s possible to gain new insights into the world of…

X-ray satellite XMM-newton sees ‘space clover’ in a new light

Astronomers have discovered enormous circular radio features of unknown origin around some galaxies. Now, new observations of one dubbed the Cloverleaf suggest it was created by clashing groups of galaxies….