On the Suitability of the Calibration of Private Equity Risk in the Solvency II Standard Formula

The drawing-up of Solvency II prudential rules has become a matter of major concern for the private equity sector. Its financial impact can be large. As an example, in the French market, in 2007, the total investments in private equity represented €22bn in the balance sheet of insurance companies (FFSA 2008).

They finance 21% of the funds raised (AFIC); thus becoming the leading national investors in unlisted stocks. The current measure for private equity risk, used by the European regulator, leads to a correlation of 0.75 between the performance of private equity and that of listed equities. It is likely to dissuade insurers from investing in this class of assets. The EDHEC Financial Analysis and Accounting Research Centre study examines the robustness of this correlation coefficient and the methodology used to obtain this value.

In addition to casting doubt over the use of VaR (Value at Risk), which requires the implementation of correlation matrices that have been very controversial to date, the EDHEC study questions the representativeness of the LPX50 index selected by the regulator to measure the capital required for private equity investment risk. This index, which is defined on the basis of the stock prices of the fifty largest listed private equity firms in the world (i) is not representative of investments of European insurance companies, either on a geographical level or as a representation of the weight of investments in venture and buy-out, (ii) does not reflect the non-liquid contractual nature of investments in private equity, and (iii) as a result of the underlying investments, the LPX50 poses an idiosyncratic risk that is added to the risk of investment in private equity.

To correct the identified drawbacks of the CEIOPS (Committee of European Insurance and Occupational Pensions Supervisors) approach, EDHEC’s proposal involves replacing the LPX50 index with a benchmark that is more representative of insurance portfolios invested in private equity. The analysis is based on the performance of private equity funds for various investment classes and geographical zones, taken from the Thomson One database. In accordance with the practices of the private equity industry and academic approaches, the EDHEC Financial Analysis and Accounting Research Centre calculated the internal rates of return (IRR) of private equity funds by vintage year, and then measured the return of an equivalent investment in the MSCI indices, with the same portfolio structure as the private equity benchmark (vintage year, incoming and outgoing cash flows, geographic zone). This index is known as the Public Market Equivalent Plus (PME +).

The correlation between private equity and listed market performance is measured using four families of private equity investments (two geographical zones combined with two types of investment: buy-out and venture). In order to provide an optimal reflection of European insurance companies’ investments, these four families were then aggregated into a single portfolio. The results (both by family and for the aggregated portfolio) show that private equity performance is significantly less correlated to that of listed equity markets than assumed in the 0,75 correlation coefficient selected by the CEIOPS ; it lies between 0,11 and 0,54 according to the geographical zone and the type of investment.

Finally, the study shows through simulations the impact of the level of the correlation coefficient (representing diversification in investments) not only on the capital requirement for equity risk but also on the marginal cost of the capital requirement as a consequence of asset reallocation between listed equities and private equity.

This study has received support from the British Private Equity and Venture Capital Association, BVK, the European Private Equity and Venture Capital Association, and was presented to the Ministry of Economy at the Prudential Regulatory Authority.

Media Contact

All latest news from the category: Studies and Analyses

innovations-report maintains a wealth of in-depth studies and analyses from a variety of subject areas including business and finance, medicine and pharmacology, ecology and the environment, energy, communications and media, transportation, work, family and leisure.

Newest articles

A universal framework for spatial biology

SpatialData is a freely accessible tool to unify and integrate data from different omics technologies accounting for spatial information, which can provide holistic insights into health and disease. Biological processes…

How complex biological processes arise

A $20 million grant from the U.S. National Science Foundation (NSF) will support the establishment and operation of the National Synthesis Center for Emergence in the Molecular and Cellular Sciences (NCEMS) at…

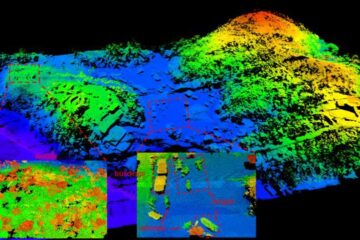

Airborne single-photon lidar system achieves high-resolution 3D imaging

Compact, low-power system opens doors for photon-efficient drone and satellite-based environmental monitoring and mapping. Researchers have developed a compact and lightweight single-photon airborne lidar system that can acquire high-resolution 3D…