Are you ready to retire?

There comes a time in each of our lives when we consider starting a pension plan –either on the advice of a friend, a relative, or of our own volition. The plan of choice may depend on various factors, such as the age and salary of the individual, number of years of expected employment, as well as options to retire early or late.

One possible plan is a defined pension plan, where the benefit amount is typically based on the employee’s number of years of service at the time of retirement and the salary and/or average salary over an employment period. For instance, the employee may receive a fraction of the average salary during a certain number of years.

In a paper published last month in the SIAM Journal on Applied Mathematics, authors Carmen Calvo-Garrido, Andrea Pascucci, and Carlos Vázquez present a partial differential equation (PDE) model governing the value of a defined pension plan including the option for early retirement.

“The employer bears the liability of the pension and the value of this liability is understood as the value of the pension plan,” says author Carlos Vázquez. “It is important to develop mathematical models to compute the value of this liability in order to estimate the financial situation of the institution or company that has the obligation with the pension plan member.”

The analysis in the paper uses modeling tools similar to those used in quantitative finance, for instance, for pricing American options.

The model assumes that the wage or salary of an employee at any given time is governed by a stochastic differential equation, which in turn depends on the time of recruitment, current salary of the employee and age of entry. Uncertainty of the salary is assumed to depend only on volatility, which refers to the uncertainty or risk associated with a value or asset. “Models need to reproduce the uncertainties associated with the underlying factors of the plan (salary, interest rate and so on) and should allow one to compute the pension plan price in order to reproduce situations in different scenarios,” author Andrea Pascucci explains.

The authors obtain the value of a defined benefit pension plan including the option for early retirement for the employee, thus computing the value of the pension plan as well as the region of early retirement. “If the pension plan incorporates the option of early retirement by the member, then the additional question arises: when is it optimal to retire? Mathematical modeling tools allow us to pose the problem in terms of partial differential equations,” says Vázquez.

The optimal retirement problem is a “free boundary problem” for the underlying PDE. Most applications of PDEs involve domains with boundaries, and certain boundary conditions need to be satisfied in order to solve the PDEs. Free boundary problems deal with solving PDEs where part of the boundary is unknown in advance, referred to as a free boundary. Thus, in addition to standard boundary conditions, an additional condition must be imposed at the free boundary. The free boundary in this problem is the optimal retirement boundary between the region where it is optimal to retire and the region where it is optimal to continue working.

“The practical solution of the PDE model to obtain pension plan prices from the data requires the use of suitable numerical algorithms to be run on a computer,” says author Carmen Calvo-Garrido. “From the numerical solutions, we can identify at each date, for a given salary and average salary, if it is optimal to retire or not, and also to obtain the value of the pension plan in any case.”

Mathematical analysis provides rigorous justification of the correctness of the model, also proving the expected qualitative properties.

Future directions may involve the application of similar modeling techniques to study the evolution of wages and salaries. “We are working on a more complete model for salaries evolution that includes the possibility of jumps (due to economic crisis, sudden increase or decrease in salaries, etc.),” says Vázquez. “PDE problems including realistic, stochastic interest rate models also present a very challenging topic. The calibration of model parameters is an interesting and difficult problem due to the need of suitable real data.”

Source article:

Mathematical Analysis and Numerical Methods for Pricing Pension Plans Allowing Early Retirement

M. Carmen Calvo-Garrido, Andrea Pascucci, and Carlos Vázquez

SIAM Journal on Applied Mathematics, 73(5), 1747–1767 (Online publish date: September 4, 2013). The source article is available for free access at the link above until February 21, 2014.

About the authors:

M. Carmen Calvo-Garrido is a researcher and Carlos Vázquez is a full professor at the Department of Mathematics in the University of A Coruña in Spain. Andrea Pascucci is a full professor at the Department of Mathematics in the University of Bologna in Italy. This research was partially funded by Spanish Ministery of Science and Innovation and by Galician Regional Government (Xunta de Galicia).

About SIAM

The Society for Industrial and Applied Mathematics (SIAM), headquartered in Philadelphia, Pennsylvania, is an international society of over 14,000 individual members, including applied and computational mathematicians and computer scientists, as well as other scientists and engineers. Members from 85 countries are researchers, educators, students, and practitioners in industry, government, laboratories, and academia. The Society, which also includes nearly 500 academic and corporate institutional members, serves and advances the disciplines of applied mathematics and computational science by publishing a variety of books and prestigious peer-reviewed research journals, by conducting conferences, and by hosting activity groups in various areas of mathematics. SIAM provides many opportunities for students including regional sections and student chapters. Further information is available at www.siam.org.

Media Contact

More Information:

http://www.siam.orgAll latest news from the category: Social Sciences

This area deals with the latest developments in the field of empirical and theoretical research as it relates to the structure and function of institutes and systems, their social interdependence and how such systems interact with individual behavior processes.

innovations-report offers informative reports and articles related to the social sciences field including demographic developments, family and career issues, geriatric research, conflict research, generational studies and criminology research.

Newest articles

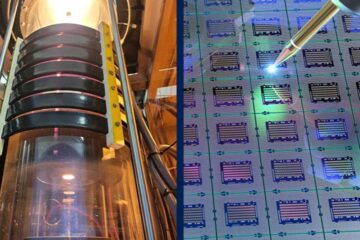

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

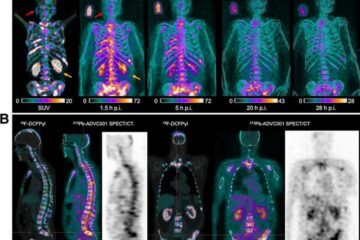

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…