Study Calls for Elimination of Credit Rating-Contingent Regulation by Governments

“If the government didn’t have these rating-contingent regulations, I believe the ratings would automatically become more informative,” says Opp, describing the findings in “Rating Agencies in the Face of Regulation: Rating Inflation and Regulatory Arbitrage,” co-written by Christian Opp, assistant professor, The Wharton School, University of Pennsylvania, and Milton Harris, professor at the University of Chicago’s Booth School of Business.

Many observers blame the 2008 financial crisis on credit rating agencies for inflating ratings and knowingly underestimating the risk of various securities, such as those backed by subprime mortgages. On the heels of the passage of the Dodd-Frank financial regulatory reform bill that makes rating agencies liable for ratings’ quality, this research offers data that supports a new approach to regulation.

The ratings issued by credit rating agencies are supposed to measure the likelihood of default for debt products. In reality, ratings may not provide an accurate picture to investors because the agencies profit from handing out high ratings. Investors are willing to pay more for an asset with a favorable rating. The goal of the research was to determine why ratings are still valued by investors even when the ratings do not depict actual risk. The study found the government’s reliance on ratings to determine the required capital held by institutional investors, such as banks, plays a key role in exposing the system’s faults.

Since the mid-1970’s, national governments have increasingly used these same ratings for regulating institutional investors. “If the importance of the regulation is too high, then a rating agency will not provide any real information to investors. It will simply inflate ratings,” Opp explains “The solution is actually quite simple. Get rid of rating-contingent regulation. Let rating agencies do their jobs without serving two purposes at the same time.”

Opp and his co-authors studied a non-competitive business model to replicate the actual market in which (effectively) only three ratings agencies (Moody’s, S&P and Fitch) exist and are virtually non-competitors.

The model indicated that rating inflation is more likely in the case of complex securities that are costly to evaluate. Opp says prior to the recent economic crisis, only one percent of bonds in the corporate bond market received a “triple A” rating while in the subprime market, 70% of assets were given this highest rating. “Our theory tells us that business grew in the subprime market because regulation did not distinguish between different asset classes,” says Opp.

Based on the paper’s conclusions, Opp believes any proposed reforms being debated in Congress will fall short if rating-contingent regulation persists and does not at least take into account the perverse feedback effects of the current regulation in place.

Marcus Opp Bio: http://www2.haas.berkeley.edu/Faculty/opp_marcus.aspx

Watch Marcus Opp talk about his research on video: http://bit.ly/a2q9vZ

See the full paper: http://bit.ly/bWT2Zn

Media Contact

More Information:

http://www.berkeley.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

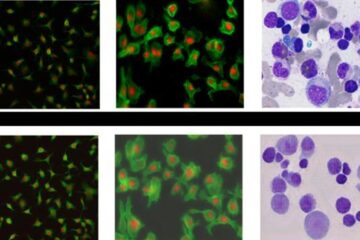

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…