Small Rise in Consumer Debt Stress Not Worrying, Economist Says

The Consumer Debt Stress Index was up less than two percent in December, to 119.8 from its November value of 118.0.

“Given the increased holiday spending by American consumers, the relatively small rise in consumer stress is not too worrying,” said Lucia Dunn, professor of economics at Ohio State University and one of the leaders of the DSI.

“Retail shopping beat analysts’ expectations for the holiday shopping season, so we know people were out charging more on their credit cards.”

The DSI is conducted by Ohio State’s Center for Human Resource Research and is based on telephone interviews of randomly selected Americans. Each month’s index score is based on the past three months of interviews, with the average sample size being 673. The DSI has been conducted monthly since January 2006, where its base value was set at 100.

The December results show that debt stress rose 4.1 points for women, while men actually experienced a drop in their DSI of 1.7 points.

Women have historically shown higher levels of debt stress than do men in the DSI, Dunn said. But the gap has been narrowing. Stress levels in December were 22.6 points higher for women than for men, compared to 50 points higher in October 2008.

The small December rise in the DSI ended a four-month streak of declining stress scores.

After hitting a high of 155.3 in July, the index dropped for four straight months, hitting 118 in November.

“These figures suggest that consumers continue to gain a measure of confidence about their ability to manage their debts after a year of wrenching economic news,” Dunn said.

“Recent positive economic signs, including some stabilization in the labor market, have helped to ease consumer fears that their debt levels might be more than they could handle without a steep reduction in lifestyle.”

But Dunn cautions that Americans are still somewhat jittery about their debts. The December index is still considerably higher than the low level reached in May 2007 just before the collapse of the subprime mortgage market. At that point, the DSI stood at 90.3.

“We have some way to go before consumers feel as confident about being able to manage their debts as they did before the onset of the recent economic downturn,” she said.

The DSI also measures the specific effect of debt stress on family life, job performance and health. While fewer people felt the negative effect of debt stress on family life and job performance in December, more people felt debt stress affected their health.

The number of people who said debt stress “very much affected” their health rose to 5.1 percent in December from 4.2 percent in November.

“Before December, the general trend in the health area had been improving, so that was welcome news,” Dunn said. “But the overall numbers are still troubling.”

Contact: Lucia Dunn, (614) 292-8071; Dunn.4@osu.edu

Media Contact

More Information:

http://www.osu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

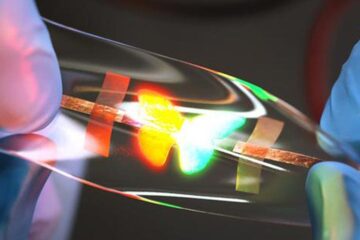

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…