Researchers Develop Index of Innovative Companies

A study from the USC Marshall Center for Global Innovation co-authored by Gerard Tellis, Professor and Director of the Center and Andreas Eisingerich Assistant Professor at Imperial College London, has developed an index of innovative firms. Portfolios of top firms on this index appear to perform better than the S&P 500 in up markets and almost as well in down markets. The superior performance comes without excessive risk.

“The results suggest that innovation is a valid criterion of portfolio formation, just as the current criteria of size, value, growth, and price,” said Tellis.

The study’s sample is drawn from Fortune’s list of the 300 largest US firms and Business Week’s list of the 100 most innovative firms, between 2004 and 2008. The innovation index is based on five metrics that use objective market data as opposed to polling. All data are collected from public market sources by two independent research assistants under supervision of a statistician.

“Polls suffer from the tyranny of hype” says Tellis, “Names that get early recognition get greater visibility in the press, which accentuates their popularity, leading to a positive cascade in their favor.”

“A crucial aspect of this index is the link between innovation measured on this index and current and future financial performance,” says Tellis.

The superior performance holds not only in current year performance but also in one-year-ahead performance. “The ultimate test of an index is whether it can predict stock market performance a year ahead,” says Eisingerich. For example:

• In the five years between 2004 and 2008, an annual paper investment of $10,000 in a portfolio of top 20 firms in the Index yields a cumulative return that is 46% higher than the S&P 500 for concurrent years

• For one-year-ahead performance the increase in returns is 23% for the top 20 portfolio over the S&P 500

The authors are updating the study to include 2009 and 2010 data and plan to test the performance of the index on real investments.

The full-report and details of the findings are available at the Center’s website (http://www.marshall.usc.edu/cgi/innovation). Details of the method, metrics, & ranking of firms by year are available from the Center at innovation@marshall.usc.edu

Media Contact

More Information:

http://www.usc.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

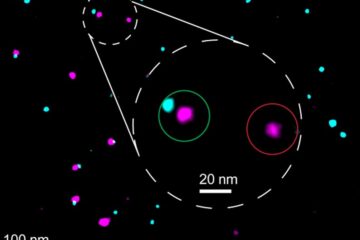

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…