ECS to develop automated agents for the stock market

Professor Nick Jennings, ECS Professor of Computer Science, led a team which won the Trading-Agent Competition (TAC) – CAT Tournament (http://www.marketbasedcontrol.com/blog/index.php?page_id=5) which was held in Toronto in July. The other team members were Dr Perukrishnen Vytelingum, Dr Ioannis Vetsikas and Dr Raj Dash. The team is now developing this automated stock market further.

The aim of the competition was to create software that would control a stock market, populated by automated trading agents, in the most effective way. In particular, this involved adjusting the market parameters (the cost of listings, the amount of information given out to traders and the fees charged) to create a market that is more appealing than the others that are available.

The ECS team, IAMwildCAT beat nine other teams, with a score four times higher than the team with the lowest score. The overall outcome is judged based on how the competing markets increase their market share; increase the amount of profit they make and the transaction success rate over a number of trading days.

‘There are now lots of different stock markets/exchanges around the world, many of which have shifted online,’ said Professor Jennings. ‘All of these exchanges compete with one another for business and the one which works best with its different parameters will get the majority of the business. This was the case for ECS in the CAT competition. We won because we adapted the terms and conditions of our exchange to respond favourably to changing market conditions.’

This is the second computerised agent competition that a team led by Professor Jennings won this year, in July ECS also won the RoboCupRescue World Championships (www.robocuprescue.org) which was held in Atlanta.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

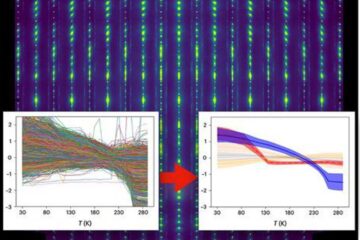

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

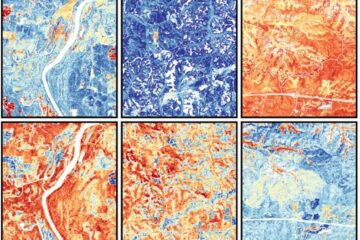

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…