The exchange rate game

What actually happens when the rate for the US dollar goes up or down by one krone in the course of a year?, asks Geir Høidal Bjønnes, associate professor at BI Norwegian School of Management.

This is a puzzle in which economists world-wide are constantly searching for the missing pieces and where macroeconomic models are of no assistance.

However what if, instead of looking at macroeconomic conditions, we study the players in this game, the large banks’ foreign exchange dealers? Can we learn more about the movements of the exchange rate by following the dealers in action? What drives currency markets? What causes rates to move up or down?

These were the first questions asked by associate professor Geir Høidal Bjønnes from BI and his fellow researcher Dagfinn Rime from Norges Bank when they sat down beside the foreign exchange dealers in one of the Nordic countries’ largest banks authorised to deal in foreign exchange. The results of their research have been reproduced in the international publication Journal of Financial Economics.

“We sat next to the foreign exchange dealers for a whole week and learned a great deal about how the market works in practice. The dealers have an incredible capacity for picking up information and a unique ability to act immediately on the basis of something they have just learned,” says Bjønnes.

The dealers were very willing to explain what was needed to succeed in the currency market and how to make sure you won more often than you lost when dealing in dollars, yen, euros, Swiss francs, kroner and other currencies. Over a burger and something to wash it down at the Aker Brygge Beach Club in Oslo, practitioners and researchers got to grips with what was involved. “It was astonishing how well our theoretical models matched with reality. There was almost 100 per cent agreement between them and the dealers’ descriptions of how they thought and what they based their trading on.”

But finance is finance, and research in this field is based on hard facts, precise models and figures by the bucket load. The researchers collected all the relevant data about the individual transactions performed during their observation period and this unique set of data was then tested in relation to different theories on how exchange rates develop. The two researchers were rewarded for their efforts and think they have found another piece of the foreign exchange movement puzzle.

“We now understand more about how exchange rates change,” says Bjønnes, who can provide documentation from the study showing that the information the exchange dealer picks up actually does contribute to explaining how the exchange rate moves. This information can be anything from macro figures such as new American import and export figures to everything under the sun that they pick up when talking to customers or other dealers.

“The deal itself passes on information,” explains Bjønnes. “If a customer wants to change a billion Norwegian kroner into euros, just conducting the deal will have an effect on the exchange rate.” A subsequent study has shown that what drives exchange rates first and foremost is the financial players in the market.

What can all this be used for?

“Understanding more about the movements of the foreign exchange market is valuable in itself. We want to learn more about how expectations feed exchange rates by combining knowledge about how players in the market operate (micro) with macroeconomic conditions. This has relevance for the banks who are sitting on private information about their own dealings. They can use information about their dealings for different purposes. In addition, it is important to understand what drives exchange rates, and it is here that the link to macro is important. “

Excellent research

• Geir Høidal Bjønnes (with Dagfinn Rime) published an article entitled “Dealer behaviour and trading systems in foreign exchange markets” in the Journal of Financial Economics in 2005.

• The Journal of Financial Economics is one of the world’s most respected publications in its field.

• BI’s academic environment in finance was reckoned by the journal Financial Management as one of the best in Europe, and second only to the London Business School.

Media Contact

More Information:

http://www.bi.no/templates/NyhetsArtikkel____39170.aspxAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

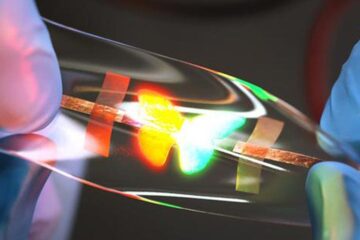

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…