Essays on Euro Area Enlargement

Marketta Henriksson’s dissertation examines issues related to the adoption of the euro by the new Central and Eastern European EU Member States.

The first essay studies the interaction between fiscal policy and the price level in different exchange rate regimes. The theoretical framework is based on the Fiscal Theory of the Price Level (FTPL). The results show that a credibly fixed exchange rate is inconsistent with fiscal irresponsibility, which implies that fiscal discipline is a prerequisite for successful participation in the exchange rate mechanism ERM II, while countries unable to commit to sound fiscal policies, probably should not commit to a fixed exchange rate either. Paradoxically, adoption of the common currency enables a country to conduct irresponsible policies, with the result that a rise in the debt level of one country raises the common price level of the monetary union.

In the second essay, a small open economy model is constructed, which allows the examination of the effects of Balassa-Samuelson-type growth – i.e. faster productivity growth in the traded goods sector than in the non-traded goods sector – in an intertemporal fixed exchange rate framework with a focus on the external balance, which has gained less attention in earlier research. The numerical simulations imply that the Balassa-Samuelson effect may increase the vulnerability of the economy. However, trade account deficits would appear to be a temporary phenomenon, as the deficits are decreased by the natural shift in the composition of consumption towards non-traded goods that is characteristic of catch-up.

The focus of the third essay is the effects of the EU fiscal policy rules on the fiscal variables, namely deficit and debt, and the external balance in the new Member States participating in ERM II. The numerical simulations show that a fiscal rule based on debt may be better at providing stability into the economy, while a deficit rule implies a smoother response to a transitory increase in output. External imbalances appear to be a natural part of the convergence process, which cannot be eliminated through the use of fiscal rules alone.

Media Contact

More Information:

http://helecon3.hkkk.fi/diss/All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

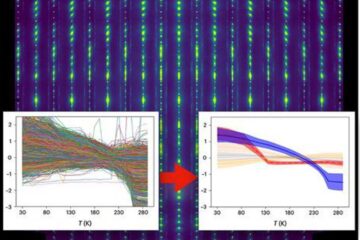

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

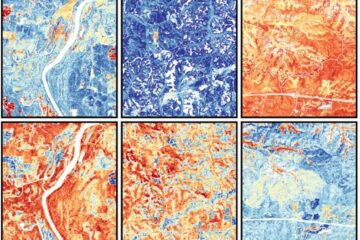

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…