Retail-farm price margins growing rapidly in Finland

The share of the wholesale and retail trade in the consumer price of food has increased rapidly in Finland over the past five years. At the same time, a declining share of the consumer food euro is allocated to farmers, according to marketing margin calculations from MTT Agrifood Research Finland.

Marketing margin calculations by MTT indicate the share of the retail price going to each sector along the supply chain: farmer, processing and trade (=marketing margin) as well as government taxes. The new figures for the period 1999-2004 reveal considerable growth in both unit and percentage marketing margins for many basic food products.

For the most part, the growth in these margins has been progressive. Average percentage margins for meat have grown the fastest. For dairy and grain products, a slightly slower growth is indicated.

Farmers in Finland, in turn, have been receiving an increasingly lower proportion of the retail price of food. The farmer’s share in the price of minced meat, for example, has declined from 33.6 per cent in 1999 to just over 23 per cent in 2004. The farmer’s share for pork chops have declined from 19.4 per cent to less than 15 per cent over the past five years.

Rising marketing margins and a declining share for the farmer have come during a period of considerable change in the structure of both the retail and wholesale sectors. The concentration of the retail sector, with fewer outlets and the growth of the large supermarket chains, has been particularly rapid in Finland. The two leading retail chains of food and daily goods increased their market share from 55 per cent in 1990 to nearly 80 per cent by 2005. The increased concentration of retail power means that large retail outlets now exert significantly more control over others in the food supply chain.

“The Finnish food sector is not alone in witnessing a growth in retail margins. This phenomenon appears to be happening across other EU markets where falling farm gate prices don’t always lead to the fall in retail prices, which increases retail margins.” says Jyrki Niemi, an agricultural economist at MTT.

“This reflects the increased market power of the retail sector, although some other factors, including more value-added at the retail level, including better service and a greater variety, play a certain role as well. There is also evidence of retail price levelling – especially for meat products. Levelling occurs where short-run fluctuations in producer prices are filtered out so as to hold retail prices stable.”

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

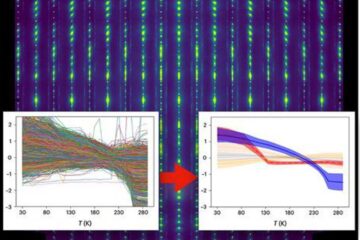

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

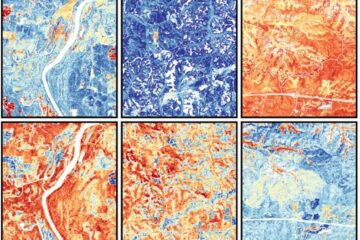

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…