EU Banking Sector Integration Falls Short of Expectations

A new Report published by the Centre for Economic Policy Research (CEPR) examines the changes that have taken place in banking in the European Union over the last few years. The authors of the third title in CEPR’s Monitoring European Deregulation (MED) series ‘Integration of European Banking – The Way Forward’ note that perhaps the most significant development that has taken place in this sector has been the launch of the Financial Services Action Plan (FSAP).

The goal of the FSAP is to create a single integrated market in Financial Services in Europe. This Report reviews progress that has been made in eliminating regulatory and non-regulatory barriers to trade in banking services and the degree to which European banking markets have become integrated. The authors document a variable level of integration in banking. It is high in wholesale banking and in certain areas of corporate finance, modest in relationship aspects of banking, low in retail banking, and patchy and heavily dependent on foreign financial institutions in the accession countries.

The authors argue that the increase in competition brought about by the introduction of the euro and more recent deregulation measures has been relatively small. To them the surprising feature of Europe’s liberalization and deregulation in banking is not that the integration is incomplete. The surprise is that market integration in some areas falls so short of expectations. The Report argues that care needs to be taken not to attempt to correct perceived low levels of integration through excessive harmonization of regulation in areas in which only modest amounts of integration can be expected. However, the authors reject the use of arguments about ownership and relationship banking to justify the retention of artificial barriers to integration. The Report recommends that further efforts are required to eliminate these barriers through:

1. The establishment of institutions to ensure the effective implementation and enforcement of the FSAP.

2. The pursuit of home country regulation and minimization of host country regulation.

3. The creation of lead regulators to co-ordinate cross-border activities.

4. Strengthening of competition policy at the EU as well as at the domestic level to prevent discrimination against cross-border activity.

5. The determination of lender of last resort facilities in the EU.

The integration programme has had a profound impact on the structure of EU banking markets. Integration has advanced through increased cross-border flows and not much through cross-border expansion. This domestic restructuring wave has led to an increase in the size of banks in all markets, and promoted the convergence of market structures, with large increases in bank size and concentration ratios in the more fragmented markets. Their analysis finds that country-specific forces are stronger than initially anticipated; in particular, economic forces, like the importance of long-term relationships, have been underestimated.

The findings of the Report imply that enacting legislation forcing the opening of entry in banking markets may not be enough to achieve a fully integrated market. The local market nature of banking competition makes it harder for legislative moves to reach a high level of market integration in some retail banking activities. Overall, the experience in the EU, even after the creation of the euro area, reveals that market integration has progressed very slowly.

A main unresolved issue is what lies behind the barriers to further market integration in retail banking. The easy and immediate answer is proximity to customers, advantages from local information and relationship business.

However, the several unsuccessful cases of entry attempts into foreign retail banking markets, namely in the smaller European markets, suggests that other factors may be at play as well. In particular, loans to residential consumers are markets where local presence and nationality still matter. A natural reference point to assess retail banking integration is the cost of cross-border transactions and by this measure barriers are still significant. The mere deployment of branch networks is no guarantee of the success of cross-border expansion.

Theories of corporate finance suggest that information problems are more serious in equity than in debt finance as a consequence of the greater information sensitivity of equity finance.

The authors therefore predicted that in a ranking of financial integration it would be most in evidence in public debt markets, least in private equity markets and somewhere in between in private debt and public equity markets. In fact, what is observed is high level of cross-border flows in private equity and only modest integration of syndicated bank lending. The authors provide a careful look at the banking systems of the accession countries.

The Report finds that the banking systems of these countries have gone through remarkable institutional development and integration of ownership, with Western European banks controlling most of the important institutions in the new member states. Old institutions have been transformed, and new ones created.

However, the integration project is far from over. Real integration has proceeded quite far in response to the liberalization of trade, but financial integration remains incomplete.

Media Contact

More Information:

http://www.cepr.orgAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

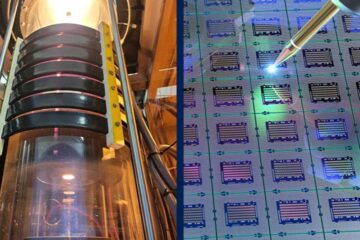

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

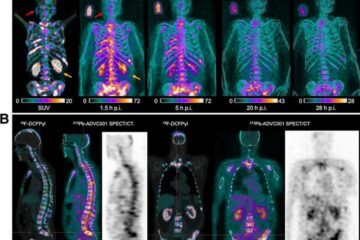

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…