According To CEPR Study US External Adjustment Is Easier Than You Think

Understanding the dynamic process of adjustment of a country’s external balance is one of the most important questions for international economists. The recent wave of financial globalization has led to a sharp increase in cross-holdings of foreign assets and liabilities. The upsurge in cross-border holdings has therefore opened the door to potentially large wealth transfers across countries. In CEPR Discussion Paper No. 4923, Pierre-Olivier Gourinchas and Hélène Rey argue that to fully explain the dynamics of the current account, economic analysis must incorporate capital gains and losses on the net foreign asset position.

While standard economic theory suggests that the US will need to run trade surpluses to reduce its current account deficits, the authors show that a substantial part of the adjustment can take place through a change in the returns on US assets held by foreigners relative to the return on foreign assets held by the US. Importantly, this previously unexplored ‘financial adjustment channel’ may transfer wealth via a depreciation of the dollar. At the moment, almost all US foreign liabilities are in dollars and approximately 70% of US foreign assets are in foreign currencies. This means that a 10% fall in the dollar would transfer 5% of US GDP from the rest of the world to the US. In comparison, the trade deficit on goods and services amounted to ‘only’ 4.4% of US GDP in 2003. The large transfers of wealth that may take place on external liabilities through the financial adjustment channel therefore significantly alter the need to run future trade surpluses or deficits.

Using a newly constructed dataset, the authors find that 30% of the adjustment towards long-run external debt sustainability of the United States is realized though financial valuation effects, on average. The effect of a fall in the dollar on the trade balance is a longer-run phenomenon and does about 70% of the work. They find that contrary to the conventional wisdom about the extent of the US external imbalance, the large revaluation of US assets that has taken place since early 2002 through the fall in the dollar has meant the imbalance is now less than in the 1980s. This is shown in the graph below, which takes into account valuation effects:

The authors caution, however, about any systematic policy seeking to depreciate the dollar to achieve valuation gains: it requires that foreign investors remain willing to accumulate further holdings of (depreciating) dollar denominated assets.

Gourinchas and Rey also use their framework to predict exchange rate depreciations. Their model consistently and decisively beats the ‘random walk’ model that is the generally accepted benchmark in economics. The random walk states that the best prediction of any future exchange rate is the current exchange rate. Therefore, the results of this paper show that another proposition of the conventional wisdom – that exchange rate modelling cannot do better than the random walk – is no longer true.

Media Contact

More Information:

http://www.cepr.orgAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

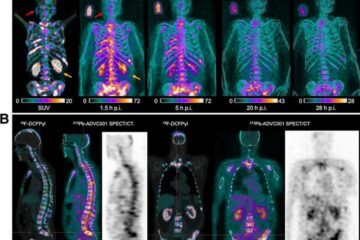

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…