IT Budget Levels Connected to Performance and Shareholder Returns

In 1978 information-technology expenditures accounted for only five percent of firms’ fixed investments, but by 2005, that figure had risen to 22 percent, for a total of $283 billion. Despite this large increase and the continuing trend toward greater investment in information technology, relatively little is known about the effects of information technology on financial performance.

In the first study to systematically investigate the effect of various contextual factors – growth, market diversification, vertical integration and type of industry, to name only a few – that influence information-technology budget decisions, an accounting researcher at the University of Arkansas found that information-technology budget levels were positively connected to subsequent firm performance and shareholder returns.

“Senior managers continue to question whether their firms are spending too much or too little on IT,” said Vernon Richardson, professor and chair of department of accounting in the Sam M. Walton College of Business. “We believe that our ability to model IT budget levels, contingent upon a set of environmental, organizational and technological factors, will help CIOs and CFOs evaluate and set their IT budgets based on a variety of industry and firm contextual factors rather than a percentage of sales.”

Richardson and his colleagues – Kevin Kobelsky at Baylor University, Robert Zmud at the University of Oklahoma and Rodney Smith at California State University, Long Beach – relied on a unique set of budget data for a group of large IT-spending firms, known as the Information Week 500, to investigate, as he mentioned, various environmental, organizational and technological factors that managers must consider while developing information-technology budgets, which include expenditures on salaries, payments to service and vendor firms, hardware and software upgrades, training and other areas. The above contextual factors include a wide range of external and internal circumstances, such as type of industry – telecommunications or energy, for example – growth opportunities, market diversification, vertical integration and need for technology. Based on an understanding of these factors, the researchers grouped firms according to their “opportunity space” and developed a model of expected or predicted budget amounts for information technology. They also modeled “residual IT,” an excess or shortfall of the predicted amount.

The researchers found that information-technology budget levels have a positive impact on financial performance and shareholder returns, but, Richardson cautioned, this doesn’t necessarily mean that the contextual factors provide a complete understanding of the amount firms should spend on information technology. Specifically, information technology’s aggregate effect on performance was a weighted average of two different components: predicted budget levels based on the contextual factors mentioned above and idiosyncratic, or firm-specific, expenditures not accounted for by the contextual factors.

“Since both of these components were positively associated with performance,” Richardson said, “we believe that the contextual factors, while beneficial to CIOs and CFOs, do not provide a complete explanation of the value of firms’ information technology expenses.”

The researchers’ findings will be published in the July 2008 issue of Accounting Review, the premier accounting academic journal.

Richardson is holder of the S. Robson Walton Chair in Accounting.

CONTACT:

Vernon Richardson, professor and chair, department of accounting; S. Robson Walton Chair in Accounting

Sam M. Walton College of Business

(479) 575-6803, vrichardson@walton.uark.edu

Media Contact

More Information:

http://www.uark.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

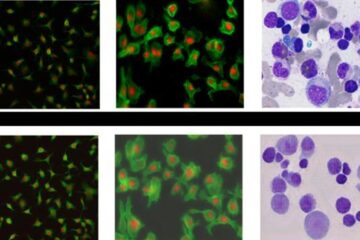

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…