IT Investments at Fortune 1000 Companies Are Riskier Than Ordinary Capital Investments

Management Insights, a regular feature of the journal, is a digest of important research in business, management, operations research, and management science. It appears in every issue of the monthly journal.

“Investigating the Risk–Return Relationship of Information Technology Investment: Firm-Level Empirical Analysis” is by Sanjeev Dewan, Charles Shi, and Vijay Gurbaxani of the University of California at Irvine.

Investment decisions are guided by both expected returns and incremental risks, the authors note. Yet, outside of anecdotal evidence, very little is known about the riskiness of information technology (IT) investments, which make up an increasingly dominant component of firms’ capital asset portfolios. This paper attempts to fill this gap by analyzing a large-scale data set of IT capital spending by Fortune 1000 companies.

The authors find that IT investments are substantially riskier than ordinary capital investments, and that IT risk is associated with a substantial risk premium. This risk premium is driven in part by the lost option value of making irreversible capital investment decisions.

A key implication of the findings is that managers should apply a substantially higher discount rate when evaluating IT investments relative to other types of less risky capital investments. Furthermore, the results suggest that the timing of IT capital investment is a critical factor in managing both the risks and returns of IT investments.

The current issue of Management Insights is available at http://mansci.journal.informs.org/cgi/reprint/53/12/iv. The full papers associated with the Insights are available to Management Science subscribers. Individual papers can be purchased at http://institutions.informs.org. Additional issues of Management Insights can be accessed at http://mansci.pubs/informs/org/.

The Insights in the current issue are:

Performance Contracting in After-Sales Service Supply Chains by Sang-Hyun Kim, Morris A. Cohan, Serguei Netessine

Implications of Breach Remedy and Renegotiation Design for Innovation and Capacity by Erica L. Plambeck, Terry A. Taylor

Implications of Renegotiation for Optimal Contract Flexibility and Investment by Erica L. Plambeck, Terry A. Taylor

The Role of Pre-Entry Experience, Entry Timing, and Product Technology Strategies in Explaining Firm Survival by Barry L. Bayus, Rajshree Agarwal

Conditions That Shape the Learning Curve: Factors That Increase the Ability and Opportunity to Learn by Eelke Wiersma

Selecting a Selection Procedure by Jürgen Branke, Stephen E. Chick, Christian Schmidt

Consumers’ Price Sensitivities Across Complementary Categories by Sri Devi Duvvuri, Asim Ansari, Sunil Gupta

A Framework for Reconciling Attribute Values from Multiple Data Sources by Zhengrui Jiang, Sumit Sarkar, Prabuddha De, Debabrata Dey

The Machine Maintenance and Sale Age Model of Kamien and Schwartz Revisited by Alain Bensoussan, Suresh P. Sethi

INFORMS journals are strongly cited in Journal Citation Reports, an industry source. In the JCR subject category “operations research and management science,” Management Science ranked in the top 10 along with two other INFORMS journals.

The special MBA issue published by Business Week includes Management Science and two other INFORMS journals in its list of 20 top academic journals that are used to evaluate business school programs. Financial Times includes Management Science and four other INFORMS journals in its list of academic journals used to evaluate MBA programs.

About INFORMS

The Institute for Operations Research and the Management Sciences (INFORMS®) is an international scientific society with 10,000 members, including Nobel Prize laureates, dedicated to applying scientific methods to help improve decision-making, management, and operations. Members of INFORMS work in business, government, and academia. They are represented in fields as diverse as airlines, health care, law enforcement, the military, financial engineering, and telecommunications. The INFORMS website is www.informs.org. More information about operations research is at www.scienceofbetter.org.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

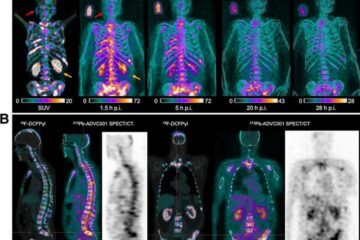

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…