Network Approach May Be the Answer to Understanding Financial ‘Contagion’

Fannie Mae and Freddie Mac, Bear Stearns, Lehman Brothers: As the major dominoes of the financial sector continue to fall at an alarming rate and the Federal Reserve attempts to forestall a systemic meltdown of the domestic financial network, University of Arkansas economists find that a network approach to the study of financial “contagion” – the transmission and impact of financial crises – may be applied to understand the current turmoil in the U.S. banking sector and the need for a systemwide response by the Fed.

A new study by Raja Kali and Javier Reyes, economics professors in the Sam M. Walton College of Business at the University of Arkansas, reveals that integration in the global financial network is a double-edged sword. On one hand, being well connected to the network can make a country more vulnerable to systemic shocks. However, this same connectedness also is associated with an increased ability to dissipate economic shocks to the system. Kali and Reyes reached these conclusions by studying how international financial crises travel though the network of global trading relationships.

Over the past decade, economists focusing on globalization and international trade have debated why financial crises – the Mexican Tequila crisis of 1994 and the Asian flu crisis of 1997, for example – spread financial contagion, while other crises had less impact. Drawing on recent advances in the study of networks, Kali and Reyes developed a new method to better explain various countries’ stock market performance in the wake of financial crises.

The researchers constructed novel network-based measures of connectedness – that is, the extent to which a country is integrated into the global trading system – and found that crises in “epicenter” countries – countries in which crises originated – were amplified if the country was better integrated into the trade network. On the other hand, “target” countries affected by these financial shocks were better able to cushion the impact of the crises if they too were well integrated into the global trading network.

Previous attempts to explain the transmission of global financial crises focused on bilateral trade relationships. Having applied the study of networks in other research projects, Kali and Reyes thought that a systemwide perspective might better explain financial contagion and the impact of crises.

Starting with the simple question, “Does integration into the international trade network make a country more vulnerable to financial crises?” Kali and Reyes used international trade data to map a global trading system as an interdependent complex network that ties countries around the world together as a whole. The trade-flow data allowed the researchers to construct a complete global network of linkages connecting 182 countries.

“Underlying this approach is the assumption that the structure of the international trade network functions as meaningful economic linkages between countries,” Reyes said. “In this spirit, we assumed the network of international trade linkages to be the backbone that underpins and motivates trade and financial flows of various kinds between countries.”

The pattern of international trade linkages allowed the researchers to obtain important indicators of country-level integration or connectedness. In their analysis, Kali and Reyes developed several distinct measures of this connectedness to the global trading system.

One measure, called “node importance,” is an index of network dependency in which some countries are defined as more important if other countries, which are also important within the network, depend on them. A country that was more important according to this measure was likely to have a greater influence on the network if it was affected by an adverse shock. A second indicator is “node centrality,” which demonstrates how central a given country is by measuring how similar it is to a perfect node, which would be a country linked to every other country.

Kali and Reyes applied these indicators to analyze five non-overlapping global financial crises – the so-called Mexican Tequila crisis, the Asian flu crisis, the Russian virus and crises in Argentina and Venezuela. They found that the network effect of the crisis epicenter country was substantially higher for the Tequila, Asian flu and Russian virus crises than for the Venezuelan and Argentine crises. In other words, Venezuela and Argentina were revealed as poorly connected target countries.

“Better connected target countries like the United States, Canada and Italy can dampen the negative effects of shocks originating in other countries,” Kali said, “while less connected countries like Ecuador, India and Venezuela cannot.”

The researchers’ study, titled “Financial Contagion on the International Trade Network,” will be published soon in Economic Inquiry.

Raja Kali, associate professor of economics

Sam M. Walton College of Business

(479) 575-6219, rkali@walton.uark.edu

Javier Reyes, assistant professor of economics

Sam M. Walton College of Business

(479) 575-6079, jreyes@walton.uark.edu

Media Contact

More Information:

http://www.uark.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

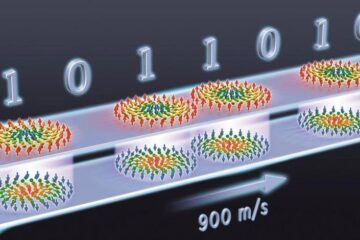

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…