Mutual fund portfolio risk increased when managers favor home-state stocks

Inexperienced mutual-fund managers and those working for funds with limited resources tend to invest too heavily in companies from their home states without the benefit of actual knowledge of the companies.

This practice translates to roughly $31 billion allocated to excessively risky portfolios each year, according to a study from the Indiana University Kelley School of Business that is the first to document and quantify this “familiarity bias” among professional investors.

The study findings indicate that mutual fund managers overweighted companies from their home states on average by 12 percent.

“Newly hired fund managers tilt their portfolios toward stocks from their home states, but their inability to deliver superior performance indicates this overweighting is not driven by concrete information,” said co-author Scott E. Yonker, assistant professor of finance at Kelley. “A weakening in the local economy of the fund manager's home could unnecessarily harm portfolio performance.”

A preference for the familiar has been well-documented among individual investors, who often lack access to in-depth investment research and time to actively manage their assets.

“Finding this familiarity bias among professionals is, of course, less expected, since portfolio diversification is rule number one,” said co-author Veronika Krepely Pool, assistant professor of finance. “Further, since we considered familiarity through just one channel — the home-state stocks — we believe our estimate of the prevalence of a familiarity bias is conservative.”

The study demonstrated that funds whose managers exhibit the largest familiarity biases hold the most inefficient portfolios. Frequently, these managers put more weight on home-state companies early in their careers, suggesting they have not fully developed ways of gathering information. Overweighting is stronger among managers who spent more time in their home states or who have fewer research resources. Finally, the practice is more pronounced in small stocks and in those that are not included in the S&P 500, have fewer sales, are followed by fewer analysts and have low advertising expenditures.

“We've shown that, like individual investors, less sophisticated managers invest in what they 'know' — or think they know,” said co-author Noah Stoffman, assistant professor of finance. “One takeaway from the study is that investors should invest in funds that are run by more experienced professionals, or diversify across managers. We also hope this study makes fund managers more aware of how they choose stocks.”

The Kelley researchers based their findings on a sample of nearly 30,000 quarterly fund observations with about 1,800 unique funds managed by roughly 2,000 individual managers. Data was obtained from several sources, including actual fund managers; the Thomson Financial CDA/Spectrum Mutual Fund database, which contains quarter-end holdings reported by U.S.-based mutual funds in mandatory SEC filings; and LexisNexis Public Records.

The study, “No Place Like Home: Familiarity in Mutual Fund Manager Portfolio Choice,” is forthcoming in Review of Financial Studies.

Media Contact

More Information:

http://www.iu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

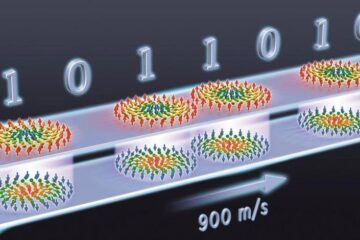

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…